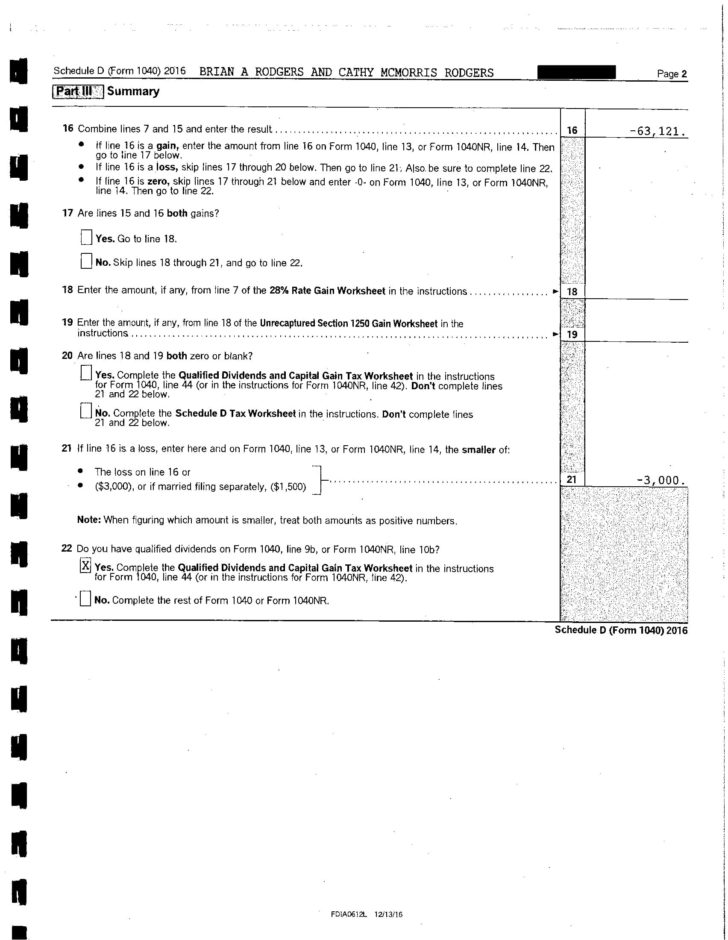

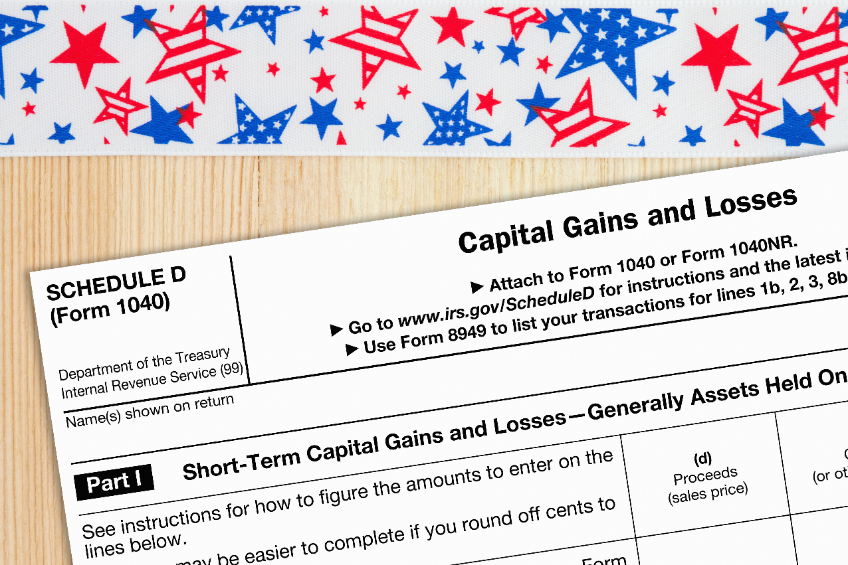

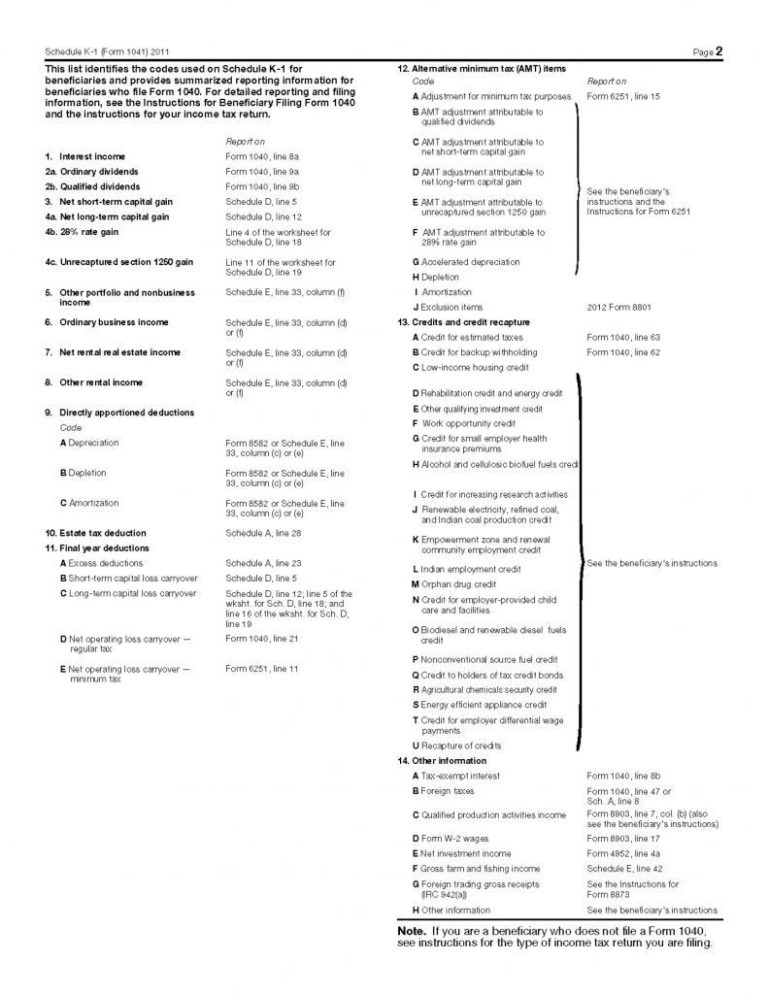

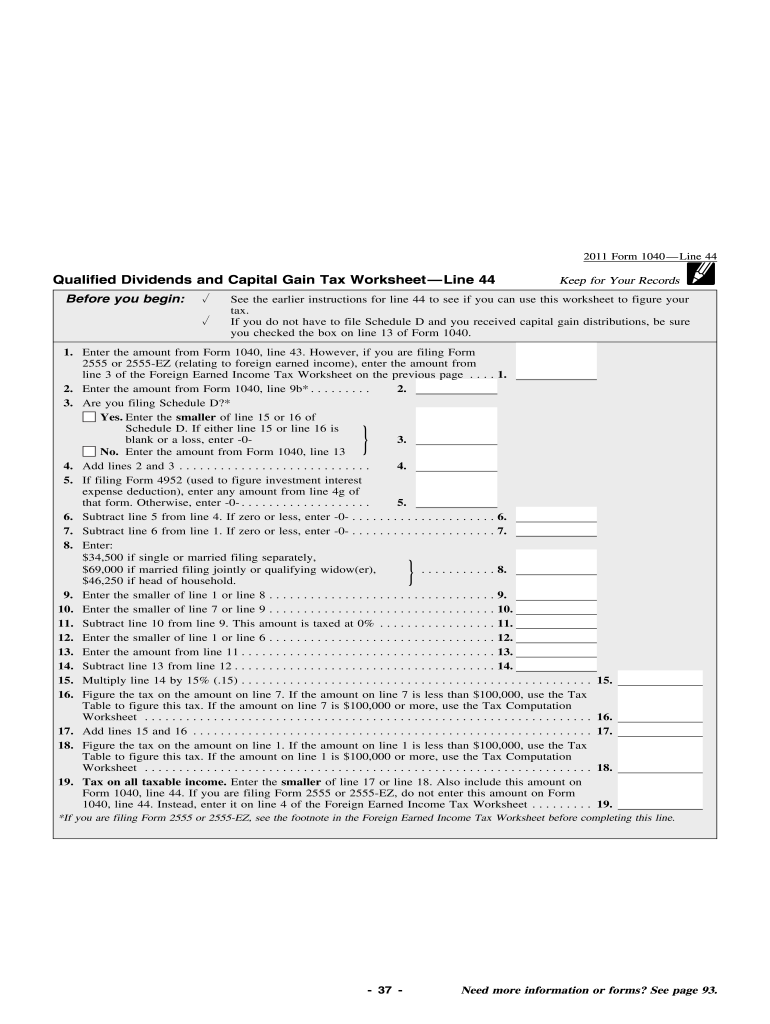

28 Percent Rate Gain Worksheet - Find out the tax rates,. 28% rate gain worksheet—line 18c keep for your records 1. 28% rate gain worksheet—line 18 keep for your records 1. Enter the total of all collectibles gain or (loss) from items reported on form 8949, part ii. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule. Enter the total of all collectibles gain or (loss) from items you reported on form 8949, part. Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts. Enter the total of any collectibles gain reported to the estate or trust on: These instructions explain how to complete schedule d (form 1040). • form 2439, box 1d;

Enter the total of all collectibles gain or (loss) from items you reported on form 8949, part. Enter the total of any collectibles gain reported to the estate or trust on: 28% rate gain worksheet—line 18c keep for your records 1. Enter the total of all collectibles gain or (loss) from items reported on form 8949, part ii. 28% rate gain worksheet—line 18 keep for your records 1. These instructions explain how to complete schedule d (form 1040). Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule. • form 2439, box 1d; Find out the tax rates,. Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts.

Find out the tax rates,. These instructions explain how to complete schedule d (form 1040). • form 2439, box 1d; Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts. Enter the total of any collectibles gain reported to the estate or trust on: 28% rate gain worksheet—line 18c keep for your records 1. 28% rate gain worksheet—line 18 keep for your records 1. Enter the total of all collectibles gain or (loss) from items you reported on form 8949, part. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule. Enter the total of all collectibles gain or (loss) from items reported on form 8949, part ii.

28 Percent Rate Gain Worksheet 2023

28% rate gain worksheet—line 18c keep for your records 1. These instructions explain how to complete schedule d (form 1040). Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule. Enter the total of all collectibles gain or (loss) from items reported on form 8949, part ii. Learn how to complete schedule d to.

28 Percent Rate Gain Worksheet 2023 Irs

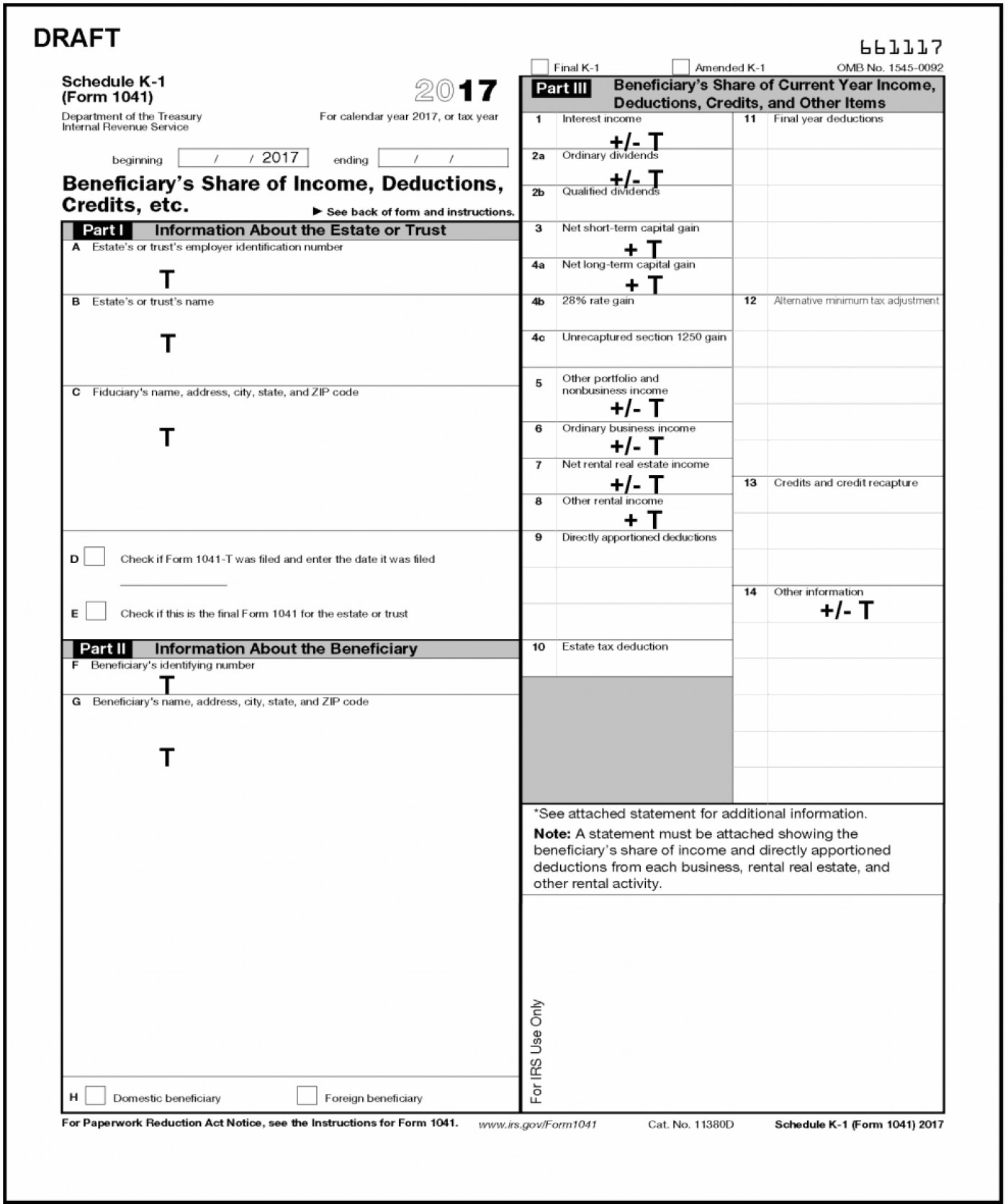

Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts. Find out the tax rates,. These instructions explain how to complete schedule d (form 1040). 28% rate gain worksheet—line 18 keep for your records 1. • form 2439, box 1d;

28 Percent Rate Gain Worksheet 2022

28% rate gain worksheet—line 18c keep for your records 1. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule. • form 2439, box 1d; Enter the total of all collectibles gain or (loss) from items you reported on form 8949, part. Learn how to complete schedule d to report capital gains and losses.

28 Percent Rate Gain Worksheet 2023 Irs

28% rate gain worksheet—line 18 keep for your records 1. • form 2439, box 1d; 28% rate gain worksheet—line 18c keep for your records 1. Enter the total of all collectibles gain or (loss) from items reported on form 8949, part ii. Learn how to complete schedule d to report capital gains and losses from various transactions of estates and.

28 Percent Rate Gain Worksheet Printable Calendars AT A GLANCE

Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule. 28% rate gain worksheet—line 18c keep for your records 1. Find out the tax rates,. Enter the total of all collectibles gain or (loss) from items reported on form 8949, part ii. Enter the total of any collectibles gain reported to the estate or.

Capital Gains Taxes and the Key Inside the 28 Rate Gain Worksheet

Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule. Find out the tax rates,. These instructions explain how to complete schedule d (form 1040). Enter the total of all collectibles gain or (loss) from items you reported on form 8949, part. • form 2439, box 1d;

Fillable Online 28 Rate Gain Worksheet Line 18 Fax Email Print

Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts. Enter the total of all collectibles gain or (loss) from items reported on form 8949, part ii. • form 2439, box 1d; Find out the tax rates,. These instructions explain how to complete schedule d (form 1040).

Irs 28 Percent Rate Gain Worksheet

These instructions explain how to complete schedule d (form 1040). Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule. 28% rate gain worksheet—line 18 keep for your records 1. Enter the total of all.

28 Rate Gain Worksheet Requirements

These instructions explain how to complete schedule d (form 1040). Find out the tax rates,. Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts. 28% rate gain worksheet—line 18c keep for your records 1. Enter the total of any collectibles gain reported to the estate or trust on:

Irs Capital Gains Worksheet 2020

• form 2439, box 1d; Enter the total of any collectibles gain reported to the estate or trust on: Enter the total of all collectibles gain or (loss) from items you reported on form 8949, part. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule. These instructions explain how to complete schedule d.

Enter The Total Of Any Collectibles Gain Reported To The Estate Or Trust On:

28% rate gain worksheet—line 18 keep for your records 1. These instructions explain how to complete schedule d (form 1040). Enter the total of all collectibles gain or (loss) from items reported on form 8949, part ii. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule.

28% Rate Gain Worksheet—Line 18C Keep For Your Records 1.

• form 2439, box 1d; Enter the total of all collectibles gain or (loss) from items you reported on form 8949, part. Learn how to complete schedule d to report capital gains and losses from various transactions of estates and trusts. Find out the tax rates,.