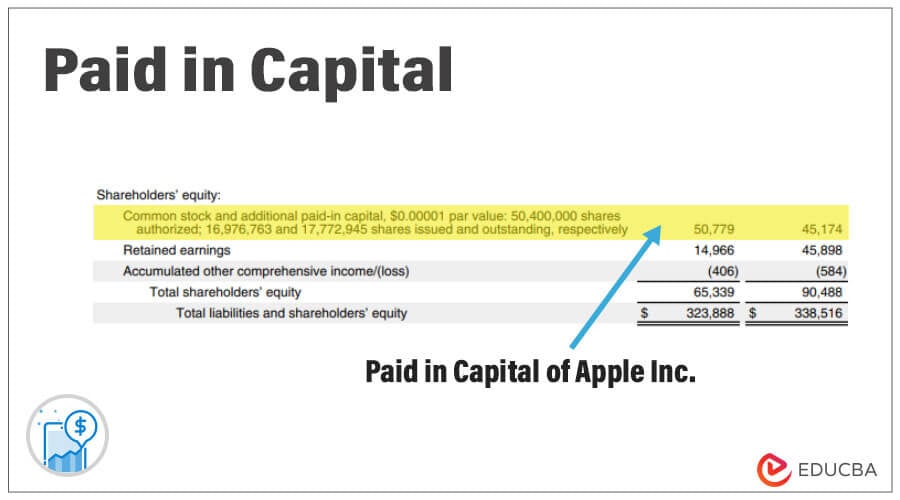

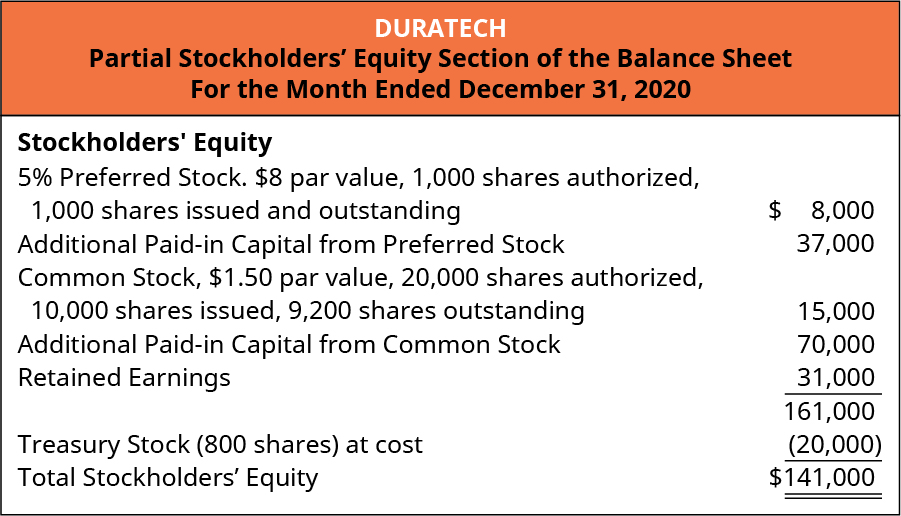

Additional Paid In Capital Balance Sheet - Web here the par value would be = (10,000 * 1) = $10,000. The excess of the sale. The par value of the shares is subtracted from the issuance price at which the shares were sold.

The excess of the sale. Web here the par value would be = (10,000 * 1) = $10,000. The par value of the shares is subtracted from the issuance price at which the shares were sold.

The excess of the sale. The par value of the shares is subtracted from the issuance price at which the shares were sold. Web here the par value would be = (10,000 * 1) = $10,000.

29+ mortgage initial disclosures RaajEleonore

Web here the par value would be = (10,000 * 1) = $10,000. The par value of the shares is subtracted from the issuance price at which the shares were sold. The excess of the sale.

Beautiful Capital Injection Balance Sheet Pepsico Financial Analysis

The excess of the sale. The par value of the shares is subtracted from the issuance price at which the shares were sold. Web here the par value would be = (10,000 * 1) = $10,000.

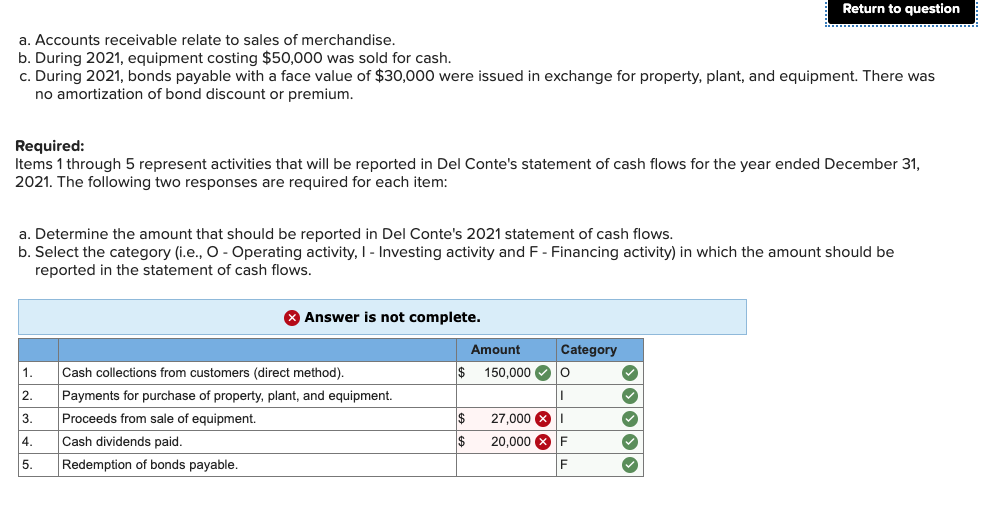

Solved Following are selected balance sheet accounts of Del

Web here the par value would be = (10,000 * 1) = $10,000. The par value of the shares is subtracted from the issuance price at which the shares were sold. The excess of the sale.

Additional Paid In Capital Definition, Calculation & Examples

The par value of the shares is subtracted from the issuance price at which the shares were sold. The excess of the sale. Web here the par value would be = (10,000 * 1) = $10,000.

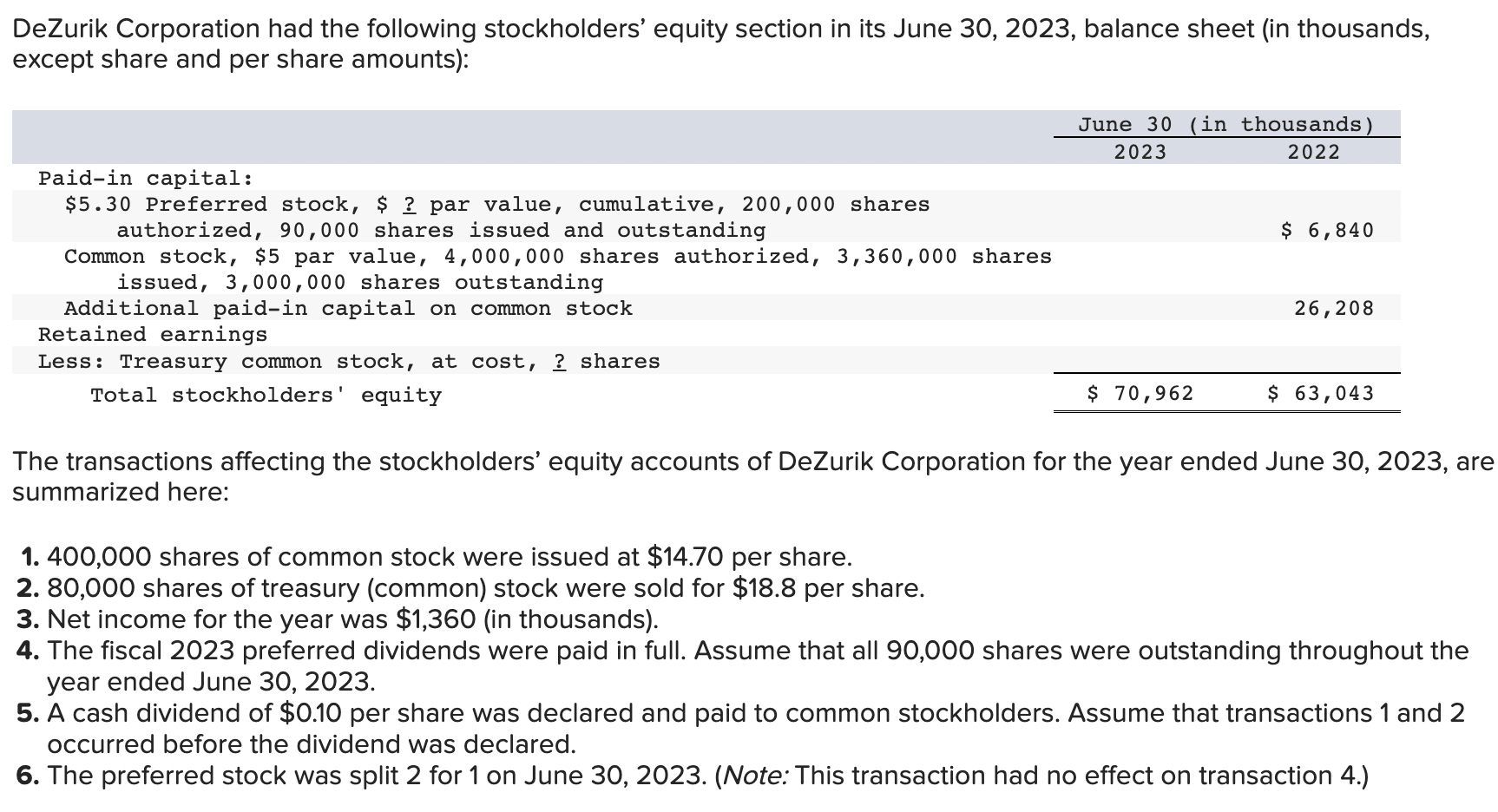

Solved DeZurik Corporation had the following stockholders’

Web here the par value would be = (10,000 * 1) = $10,000. The par value of the shares is subtracted from the issuance price at which the shares were sold. The excess of the sale.

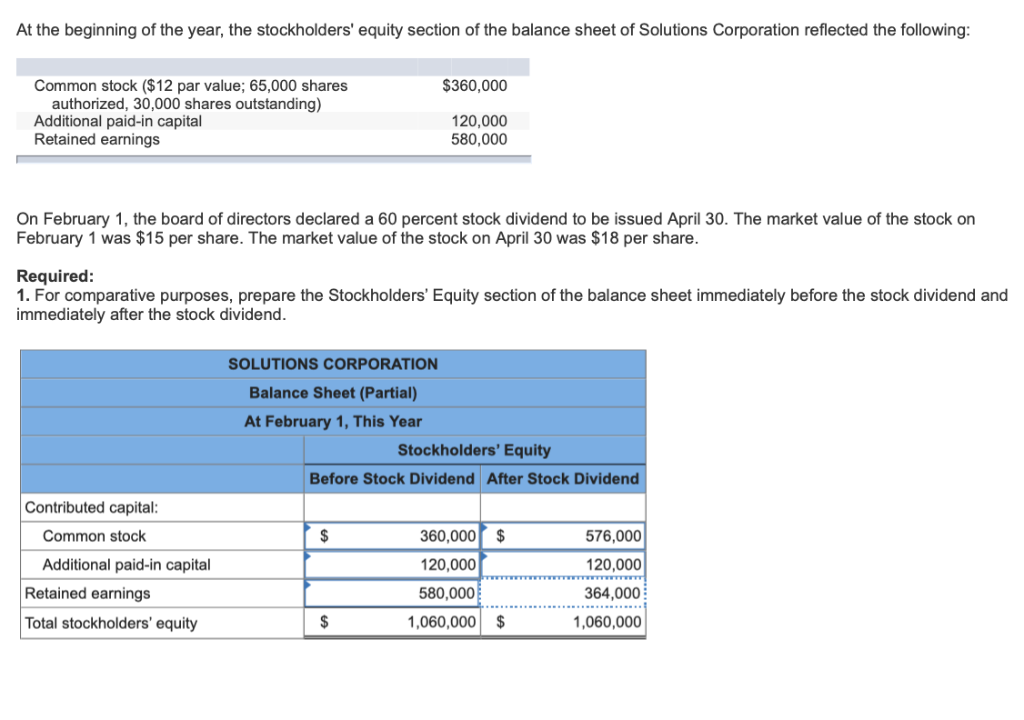

Solved At the beginning of the year, the stockholders'

The par value of the shares is subtracted from the issuance price at which the shares were sold. The excess of the sale. Web here the par value would be = (10,000 * 1) = $10,000.

Does APIC have a debit or credit balance? Leia aqui Does APIC have a

Web here the par value would be = (10,000 * 1) = $10,000. The par value of the shares is subtracted from the issuance price at which the shares were sold. The excess of the sale.

Additional PaidIn Capital (APIC) Formula + Calculation

Web here the par value would be = (10,000 * 1) = $10,000. The excess of the sale. The par value of the shares is subtracted from the issuance price at which the shares were sold.

Additional PaidUp Capital on Balance Sheet Importance and Example

Web here the par value would be = (10,000 * 1) = $10,000. The excess of the sale. The par value of the shares is subtracted from the issuance price at which the shares were sold.

Web Here The Par Value Would Be = (10,000 * 1) = $10,000.

The par value of the shares is subtracted from the issuance price at which the shares were sold. The excess of the sale.