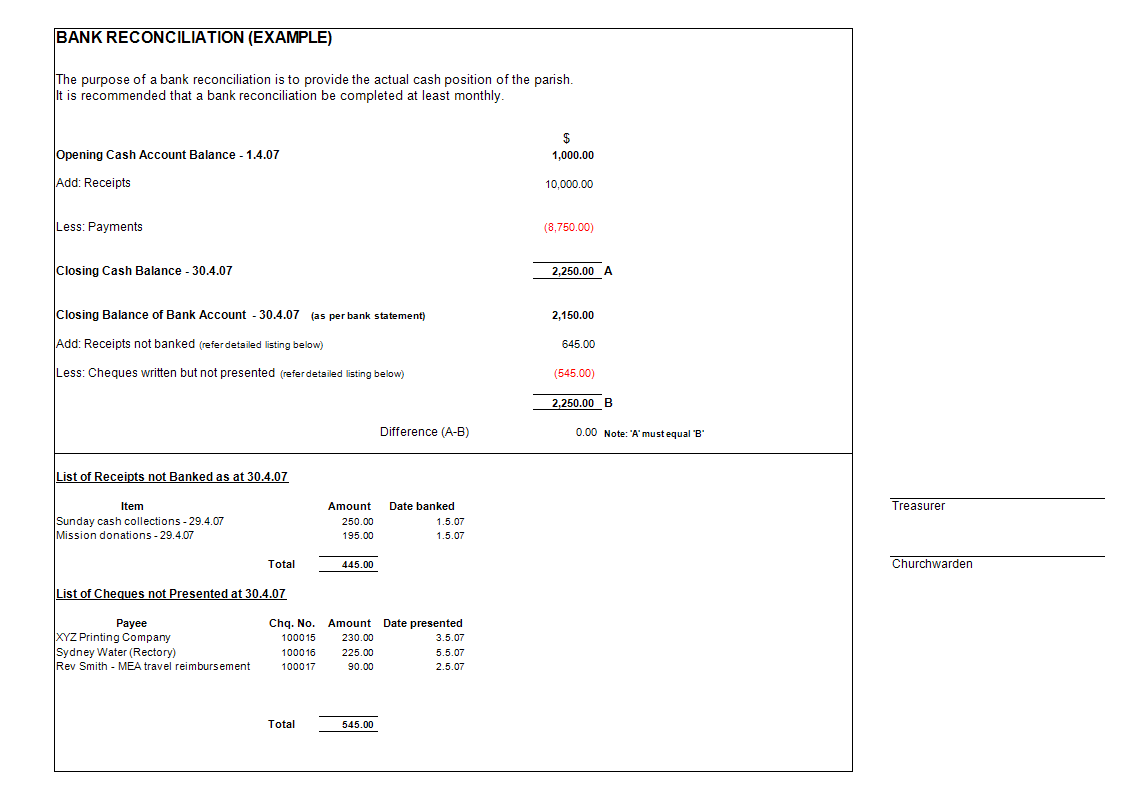

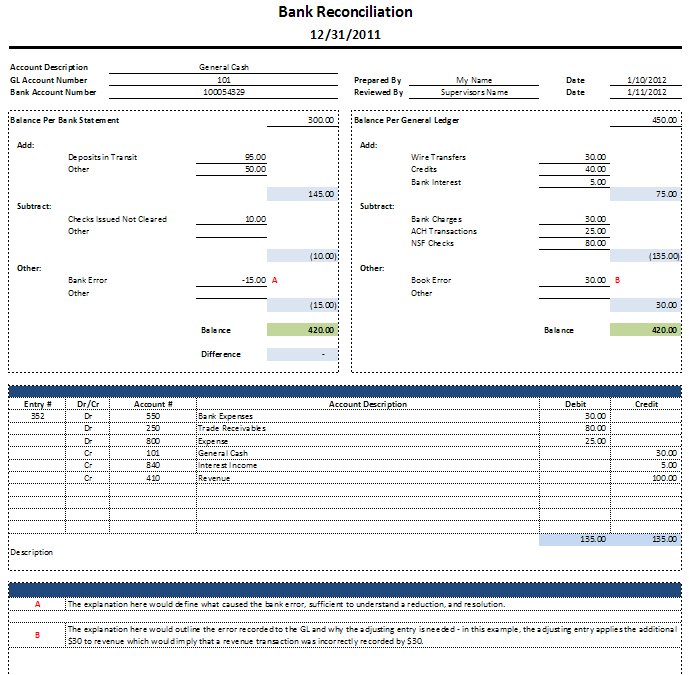

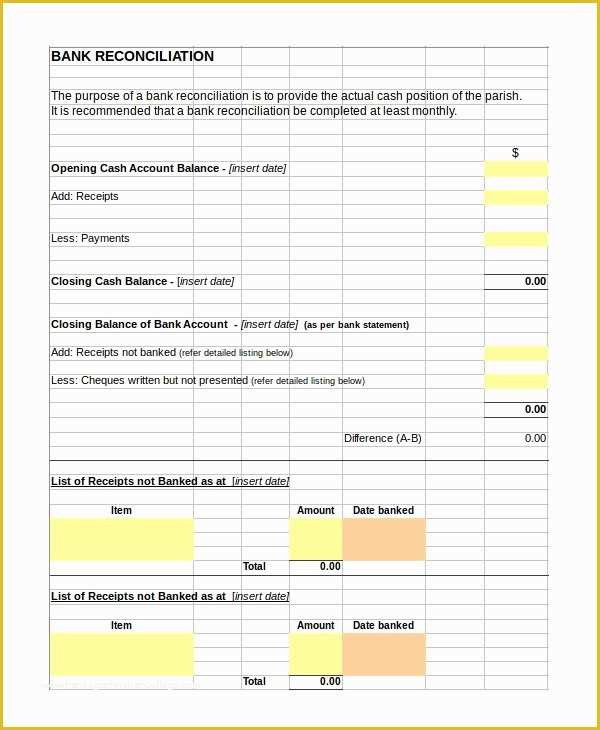

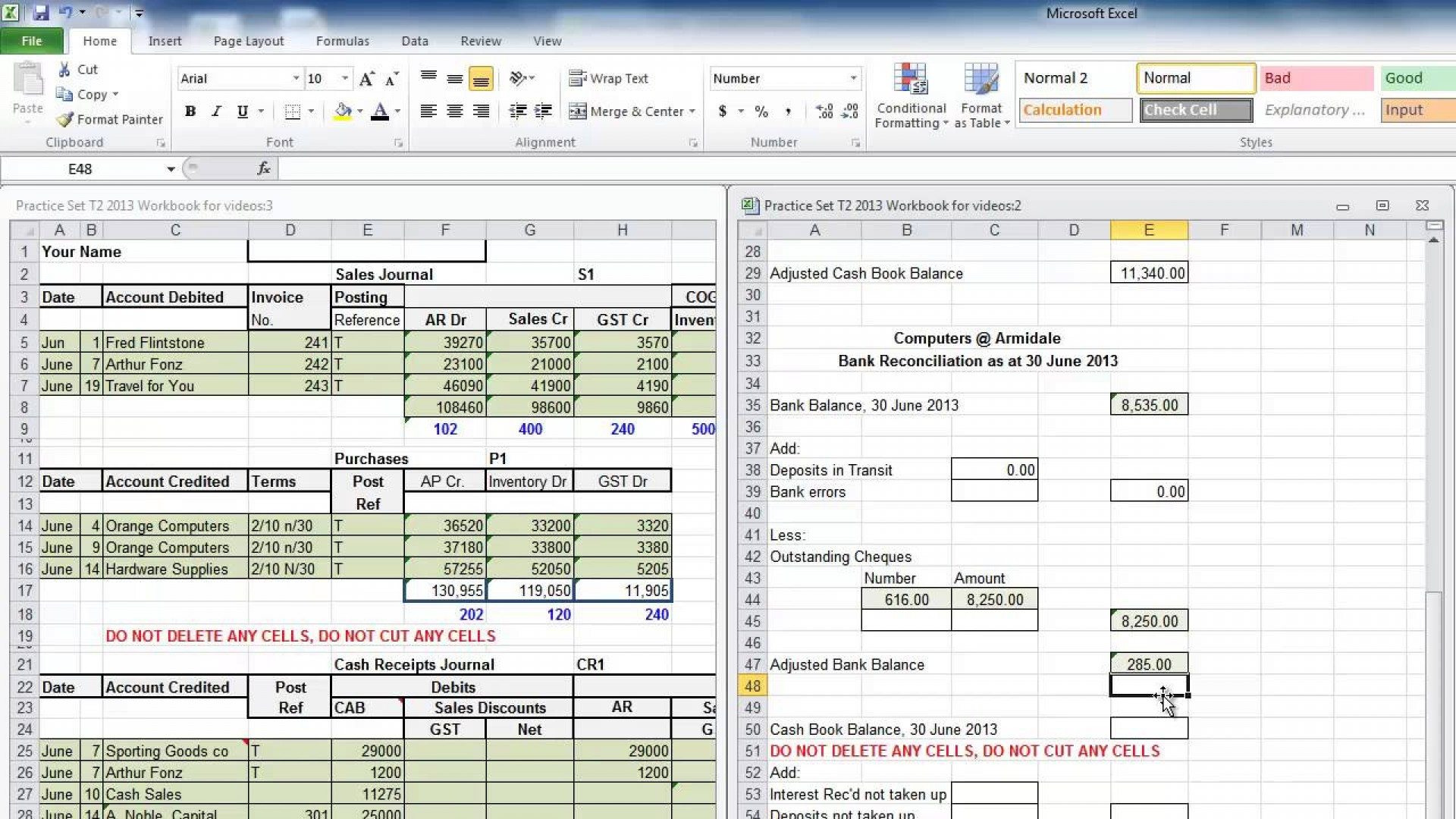

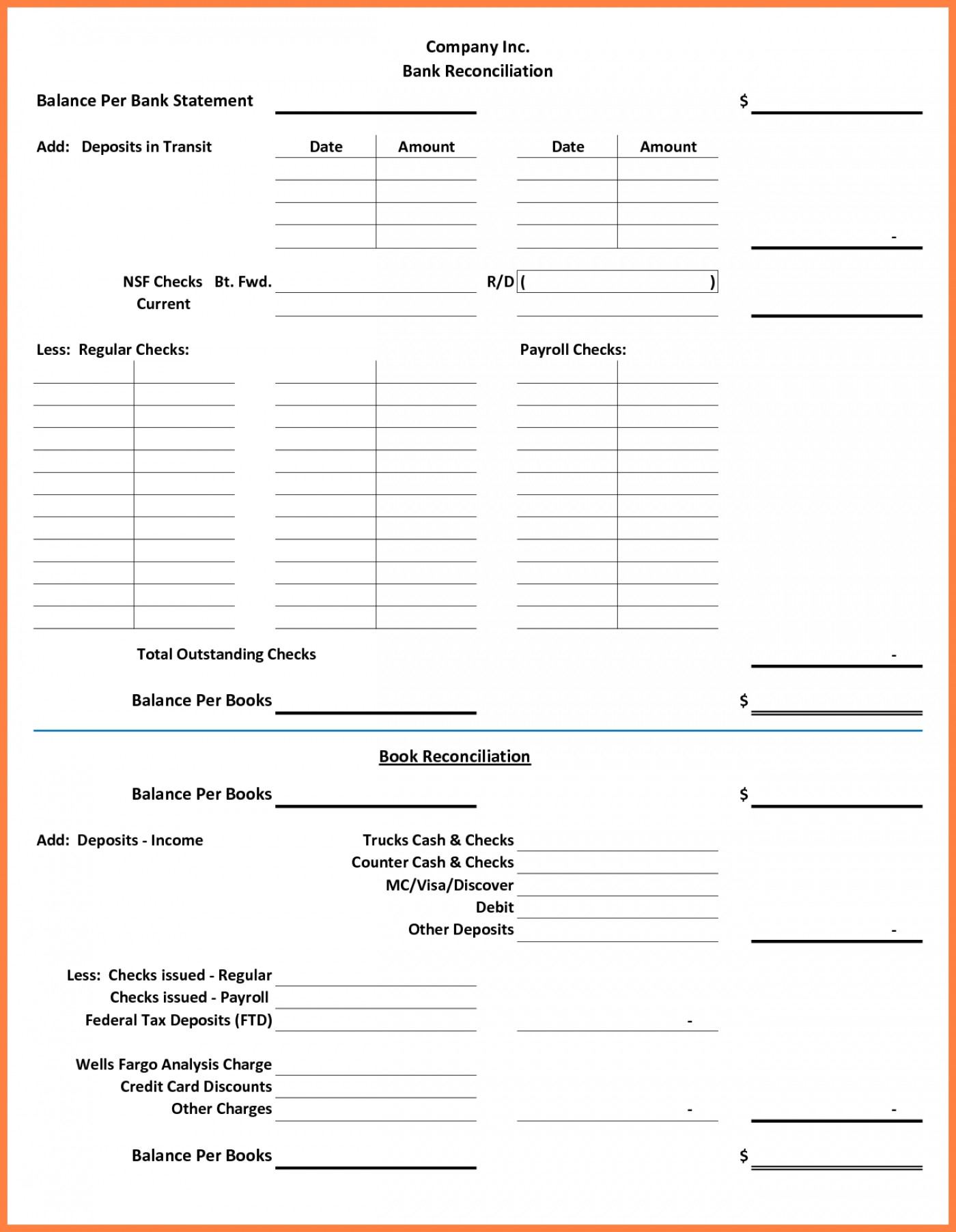

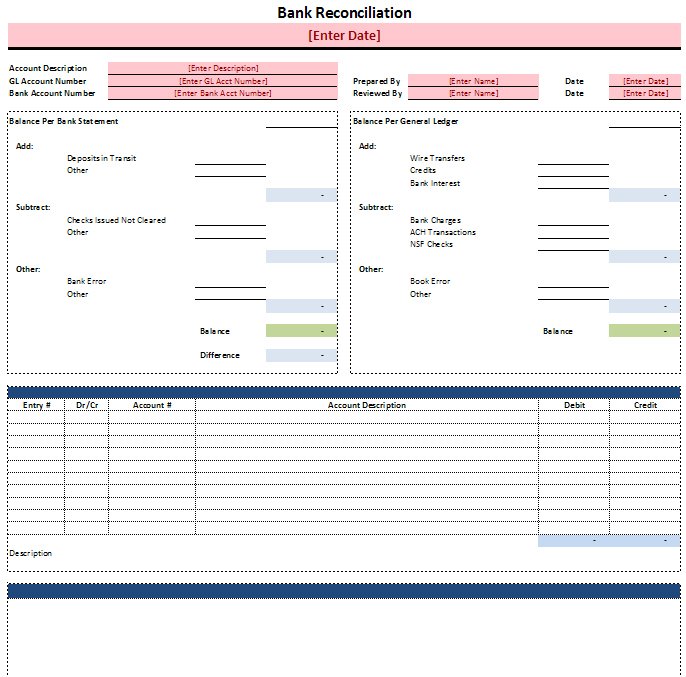

Bank Reconciliation Excel Template - Web details file format excel (xls, xlsx) size: Hence, this is one of the activities which causes a difference in balances. Web 5 steps to do bank reconciliation in excel ⭐ step 01: Adjust bank balance as per bank statement. Adjust bank balance as per depositor step 4: Enter your financial details, and the template will automatically calculate totals so that you can quickly see whether your bank statement and accounting journal are reconciled. (20 kb) download monthly bank reconciliation template details file format Find out mismatches in bank statement and cash book. Web simply download the template in.xls,.doc, pdf, google sheets or google docs to create the perfect bank reconciliation sheet for your business. Make a bank reconciliation template in excel.

Adjust bank balance as per depositor step 4: Enter your financial details, and the template will automatically calculate totals so that you can quickly see whether your bank statement and accounting journal are reconciled. In this step, we will use the match function first to. Web check out this bank reconciliation template available in excel format to help you verify and. Prepare primary outline step 3: Adjust bank balance as per bank statement. Hence, this is one of the activities which causes a difference in balances. Web 5 steps to do bank reconciliation in excel ⭐ step 01: Web details file format excel (xls, xlsx) size: Get started for free or, download the reconciliation sheet template.

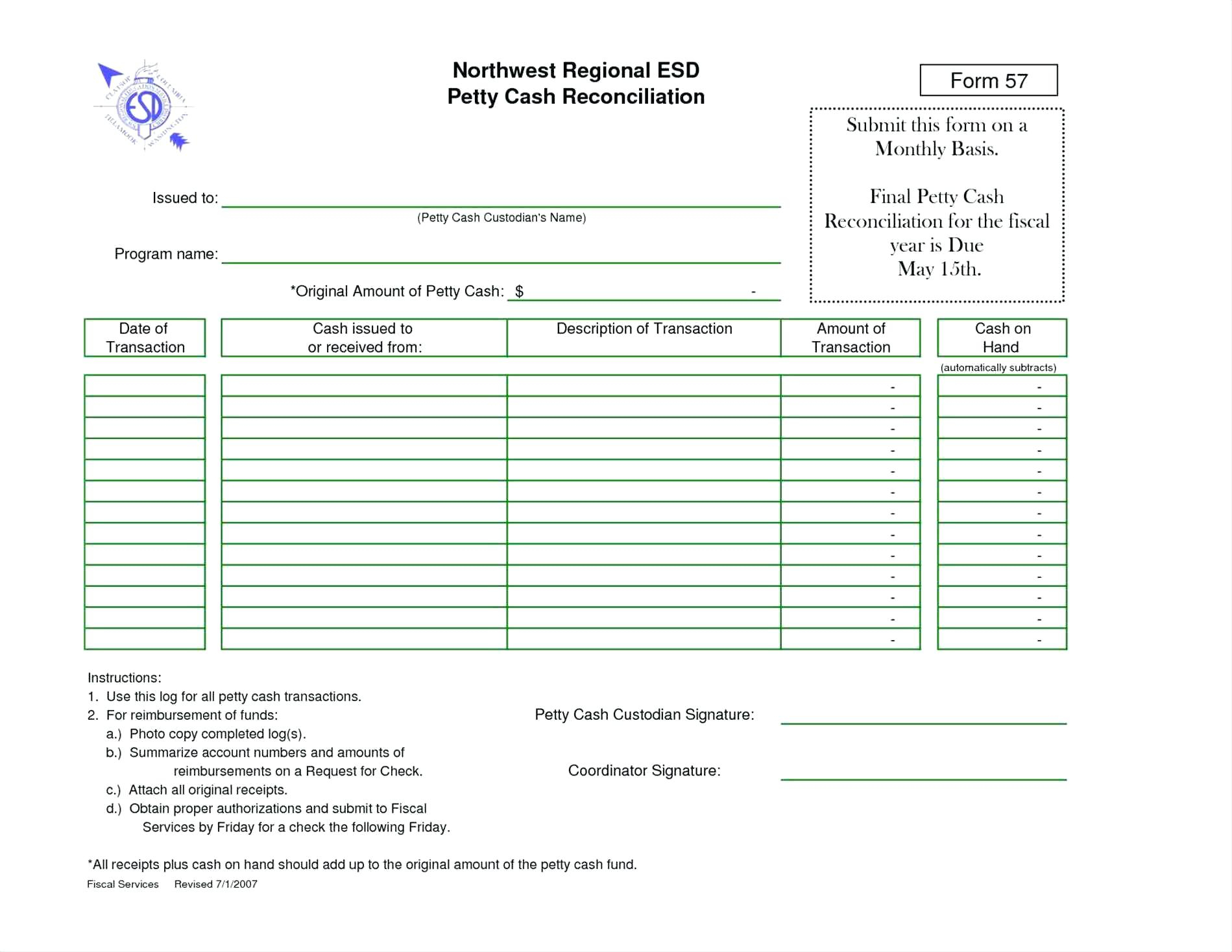

Web simply download the template in.xls,.doc, pdf, google sheets or google docs to create the perfect bank reconciliation sheet for your business. Prepare primary outline step 3: Hence, this is one of the activities which causes a difference in balances. Web bank reconciliation is the process of harmonizing the balances in an organization accounting records for a cash account to the conforming information on a bank account statement. Make a bank reconciliation template in excel. Unpresented cheques mean cheques issued by the company but not presented in bank. Enter your financial details, and the template will automatically calculate totals so that you can quickly see whether your bank statement and accounting journal are reconciled. In this case, the company will pass the entry in books as and when a cheque is issued but the bank will pass entry once it receives that cheque. Adjust bank balance as per depositor step 4: Web this simple bank reconciliation template is designed for personal or business use, and you can download it as an excel file or google sheets template.

Bank Reconciliation Excel Spreadsheet Google Spreadshee bank

Make a bank reconciliation template in excel. Web simply download the template in.xls,.doc, pdf, google sheets or google docs to create the perfect bank reconciliation sheet for your business. Input particulars for bank statement step 2: Web bank reconciliation is the process of harmonizing the balances in an organization accounting records for a cash account to the conforming information on.

Bank Reconciliation Excel Example Templates at

Get your free bank reconciliation template ready to create detailed accounting reports? Input particulars for bank statement step 2: (20 kb) download monthly bank reconciliation template details file format Get started for free or, download the reconciliation sheet template. Web 5 steps to do bank reconciliation in excel ⭐ step 01:

Bank Reconciliation Statement Template Excel Projectemplates

Get your free bank reconciliation template ready to create detailed accounting reports? In this case, the company will pass the entry in books as and when a cheque is issued but the bank will pass entry once it receives that cheque. A bank reconciliation statement is a document that matches the cash balance on a company’s balance sheet to the.

Free Excel Bank Reconciliation Template Download

Unpresented cheques mean cheques issued by the company but not presented in bank. Adjust bank balance as per depositor step 4: Web download the free template. Adjust bank balance as per bank statement. Prepare primary outline step 3:

Bank Reconciliation Template Excel Free Download Of Accounting Cash

Web this simple bank reconciliation template is designed for personal or business use, and you can download it as an excel file or google sheets template. Input particulars for bank statement step 2: Hence, this is one of the activities which causes a difference in balances. A bank reconciliation statement is a document that matches the cash balance on a.

Bank Reconciliation Excel Spreadsheet regarding 009 Template Ideas Bank

Unpresented cheques mean cheques issued by the company but not presented in bank. Hence, this is one of the activities which causes a difference in balances. Enter your name and email in the form below and download the free template now! A bank reconciliation statement is a document that matches the cash balance on a company’s balance sheet to the.

Bank Account Reconciliation Template Excel Qualads

Get your free bank reconciliation template ready to create detailed accounting reports? In this step, we will make a bank reconciliation template in. Find out mismatches in bank statement and cash book. Input particulars for bank statement step 2: Enter your name and email in the form below and download the free template now!

Excel Bank Reconciliation Template Collection

Prepare primary outline step 3: Web this simple bank reconciliation template is designed for personal or business use, and you can download it as an excel file or google sheets template. Adjust bank balance as per bank statement. Web 5 steps to do bank reconciliation in excel ⭐ step 01: Web details file format excel (xls, xlsx) size:

Bank Reconciliation Excel Spreadsheet Google Spreadshee bank

Web details file format excel (xls, xlsx) size: Web 6.1k downloads bank reconciliation template helps you automate matching records in your bank statement with your cash book. Web 5 steps to do bank reconciliation in excel ⭐ step 01: Unpresented cheques mean cheques issued by the company but not presented in bank. Web simply download the template in.xls,.doc, pdf, google.

Free Excel Bank Reconciliation Template Download

Get started for free or, download the reconciliation sheet template. Web download the free template. Hence, this is one of the activities which causes a difference in balances. (20 kb) download monthly bank reconciliation template details file format Input particulars for bank statement step 2:

In This Step, We Will Use The Match Function First To.

In this step, we will make a bank reconciliation template in. Web 6.1k downloads bank reconciliation template helps you automate matching records in your bank statement with your cash book. Web check out this bank reconciliation template available in excel format to help you verify and. Enter your financial details, and the template will automatically calculate totals so that you can quickly see whether your bank statement and accounting journal are reconciled.

Hence, This Is One Of The Activities Which Causes A Difference In Balances.

Adjust bank balance as per bank statement. Web 5 steps to do bank reconciliation in excel ⭐ step 01: Prepare primary outline step 3: Web bank reconciliation is the process of harmonizing the balances in an organization accounting records for a cash account to the conforming information on a bank account statement.

Get Your Free Bank Reconciliation Template Ready To Create Detailed Accounting Reports?

Unpresented cheques mean cheques issued by the company but not presented in bank. Make a bank reconciliation template in excel. Get started for free or, download the reconciliation sheet template. Web this simple bank reconciliation template is designed for personal or business use, and you can download it as an excel file or google sheets template.

Input Particulars For Bank Statement Step 2:

(20 kb) download monthly bank reconciliation template details file format Adjust bank balance as per depositor step 4: Web simply download the template in.xls,.doc, pdf, google sheets or google docs to create the perfect bank reconciliation sheet for your business. In this case, the company will pass the entry in books as and when a cheque is issued but the bank will pass entry once it receives that cheque.