Bonds On Balance Sheet - Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);. Generally, bonds payable fall in the non. Web thus, bonds payable appear on the liability side of the company’s balance sheet.

Generally, bonds payable fall in the non. Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);. Web thus, bonds payable appear on the liability side of the company’s balance sheet.

Web thus, bonds payable appear on the liability side of the company’s balance sheet. Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);. Generally, bonds payable fall in the non.

Bond Sinking Fund On Balance Sheet amulette

Web thus, bonds payable appear on the liability side of the company’s balance sheet. Generally, bonds payable fall in the non. Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);.

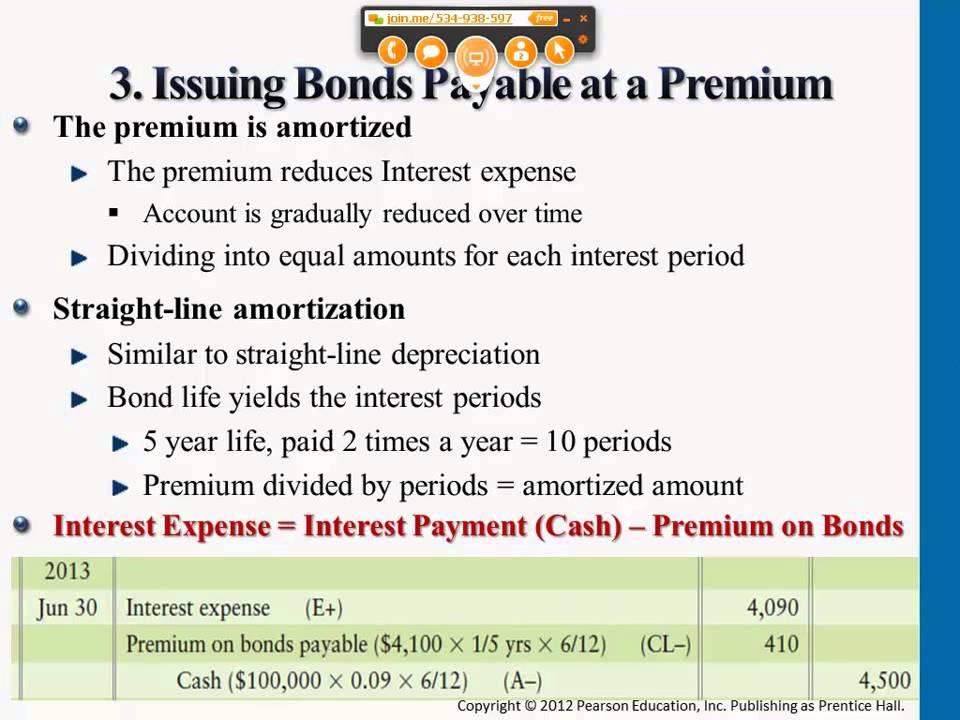

Bonds Payable at Premium Balance Sheet Presentation YouTube

Generally, bonds payable fall in the non. Web thus, bonds payable appear on the liability side of the company’s balance sheet. Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);.

Bonds Payable Formula + Calculation

Web thus, bonds payable appear on the liability side of the company’s balance sheet. Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);. Generally, bonds payable fall in the non.

Important Radioactif Sûr balance sheet items examples en relation Mise

Generally, bonds payable fall in the non. Web thus, bonds payable appear on the liability side of the company’s balance sheet. Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);.

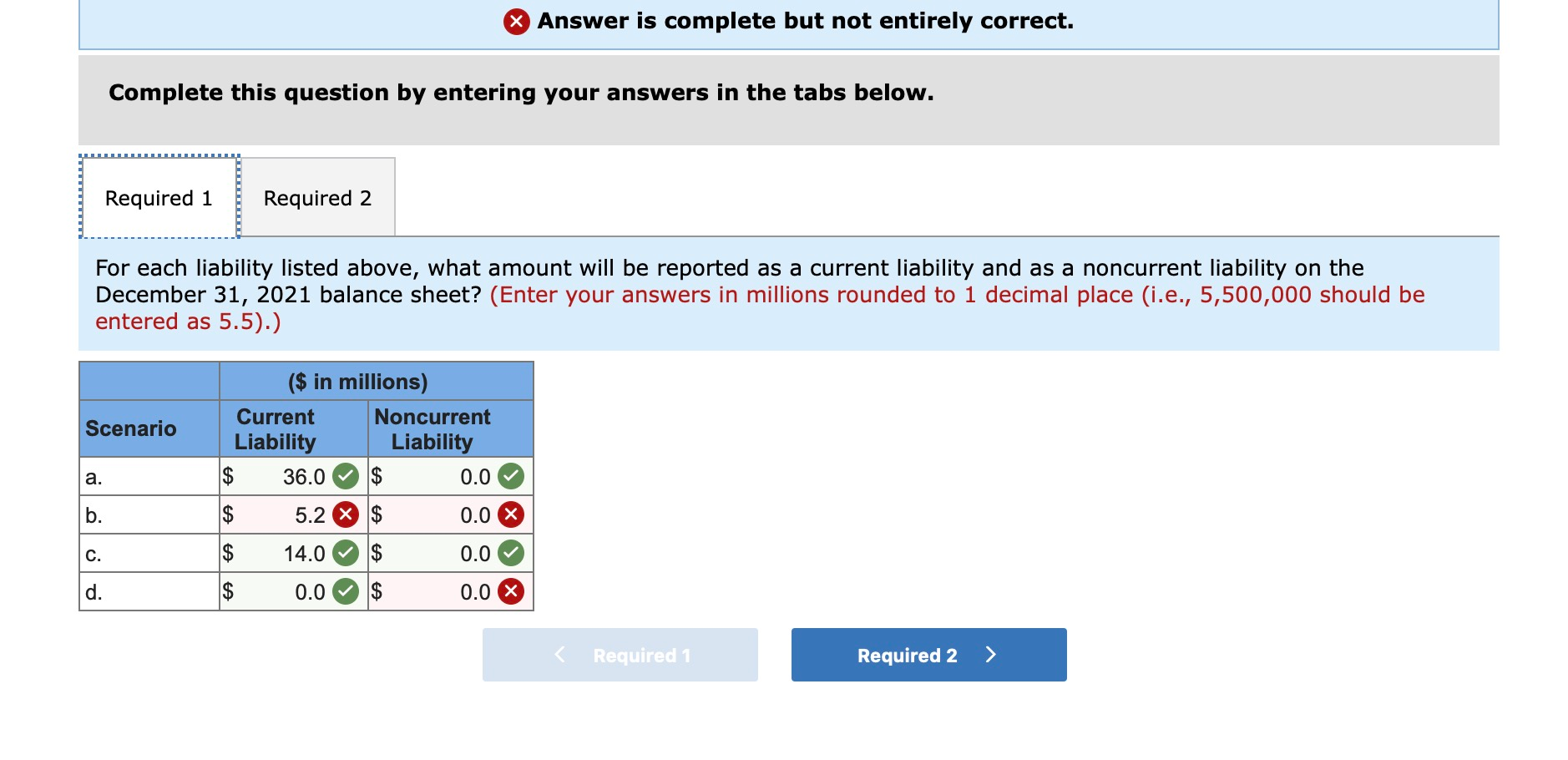

Solved The balance sheet at December 31, 2021, for Nevada

Web thus, bonds payable appear on the liability side of the company’s balance sheet. Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);. Generally, bonds payable fall in the non.

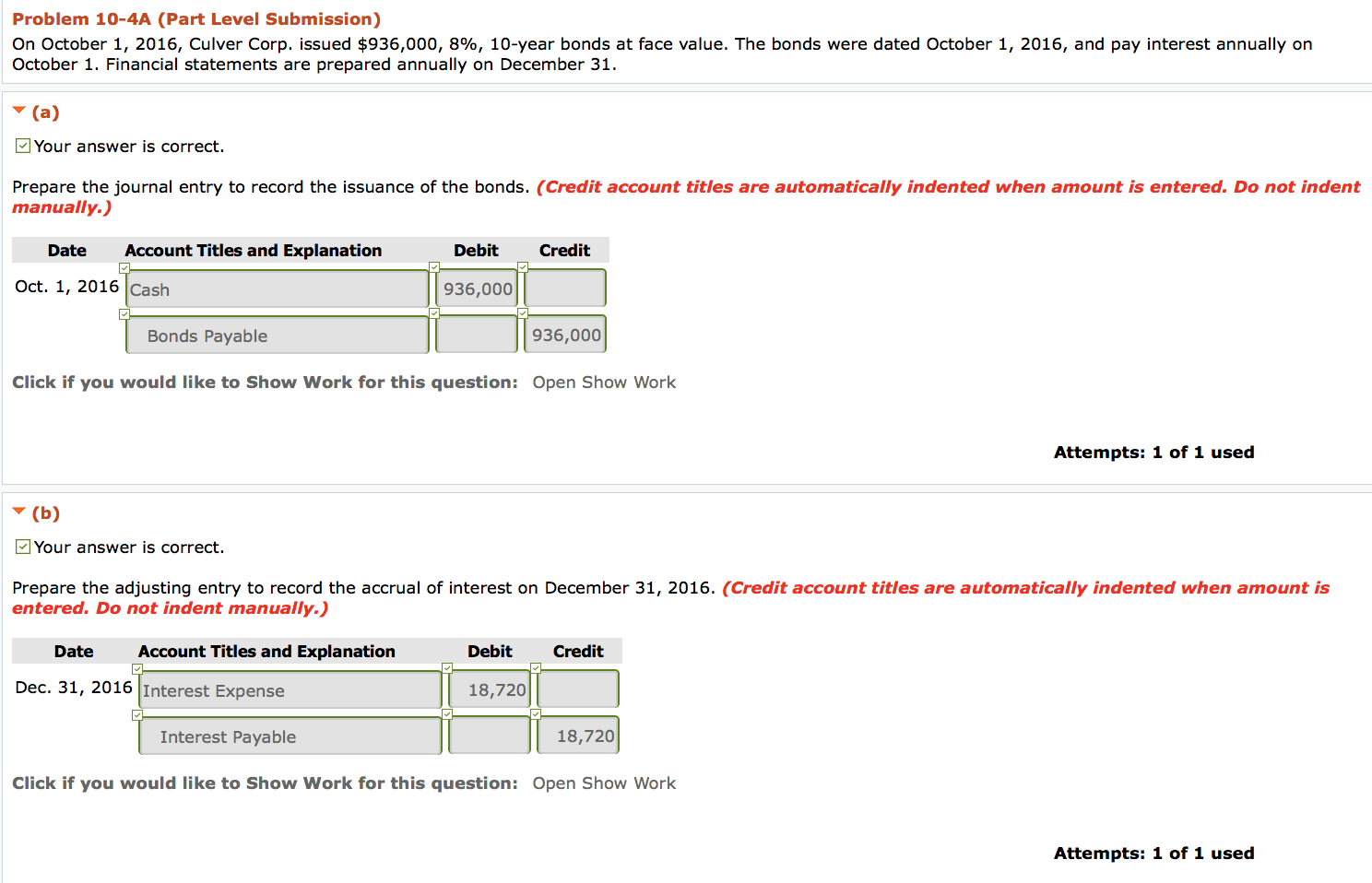

Solved (c) Your answer is correct. Show the balance sheet

Web thus, bonds payable appear on the liability side of the company’s balance sheet. Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);. Generally, bonds payable fall in the non.

Solved Question1The following are the typical

Generally, bonds payable fall in the non. Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);. Web thus, bonds payable appear on the liability side of the company’s balance sheet.

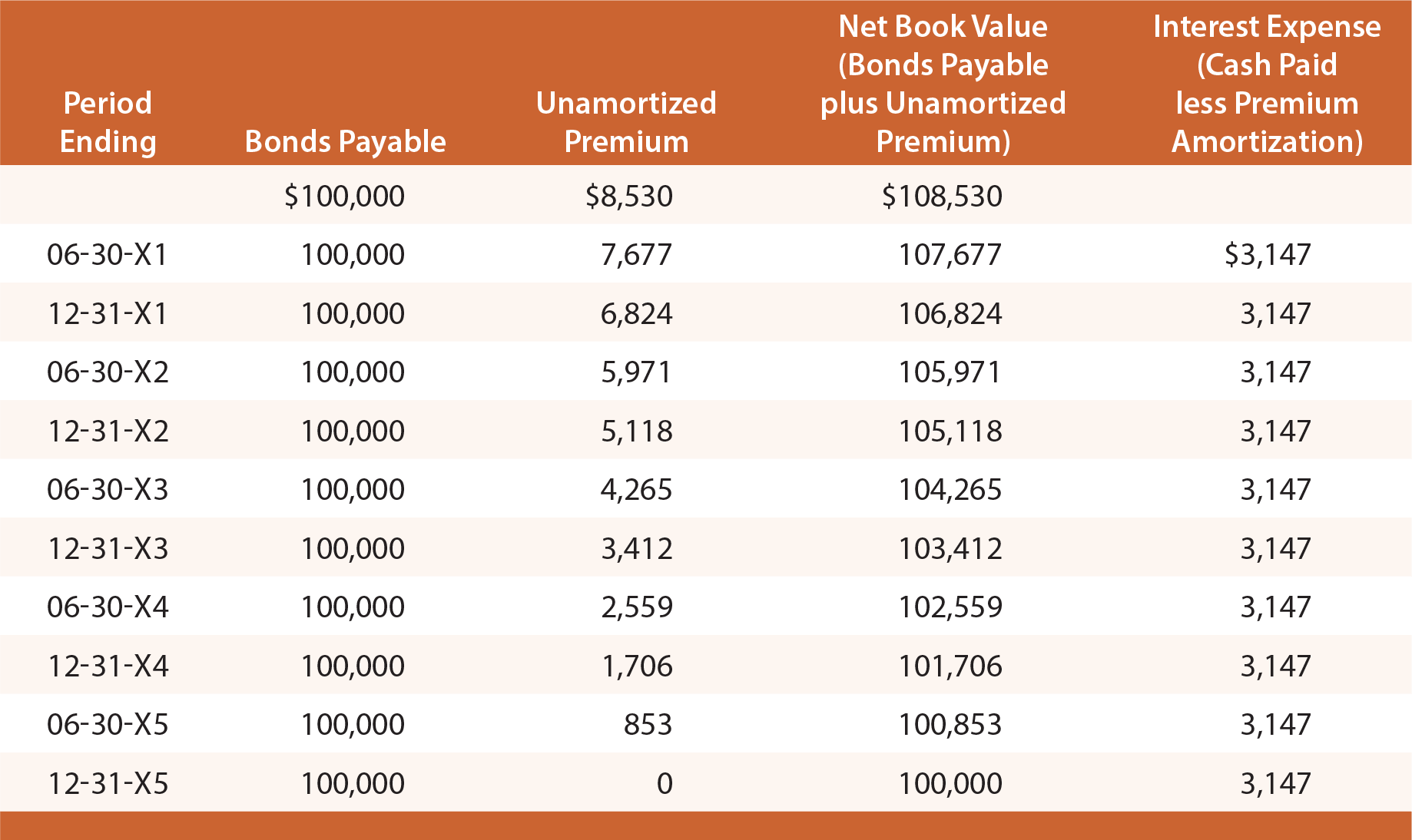

Accounting For Bonds Payable

Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);. Web thus, bonds payable appear on the liability side of the company’s balance sheet. Generally, bonds payable fall in the non.

Solved Exercise 516 A comparative balance sheet for

Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);. Web thus, bonds payable appear on the liability side of the company’s balance sheet. Generally, bonds payable fall in the non.

Generally, Bonds Payable Fall In The Non.

Web thus, bonds payable appear on the liability side of the company’s balance sheet. Web the income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);.

/investing-lesson-3-analyzing-a-balance-sheet-357264_FINAL-ff829eab9bf045c981c883c323bc0ca6.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)