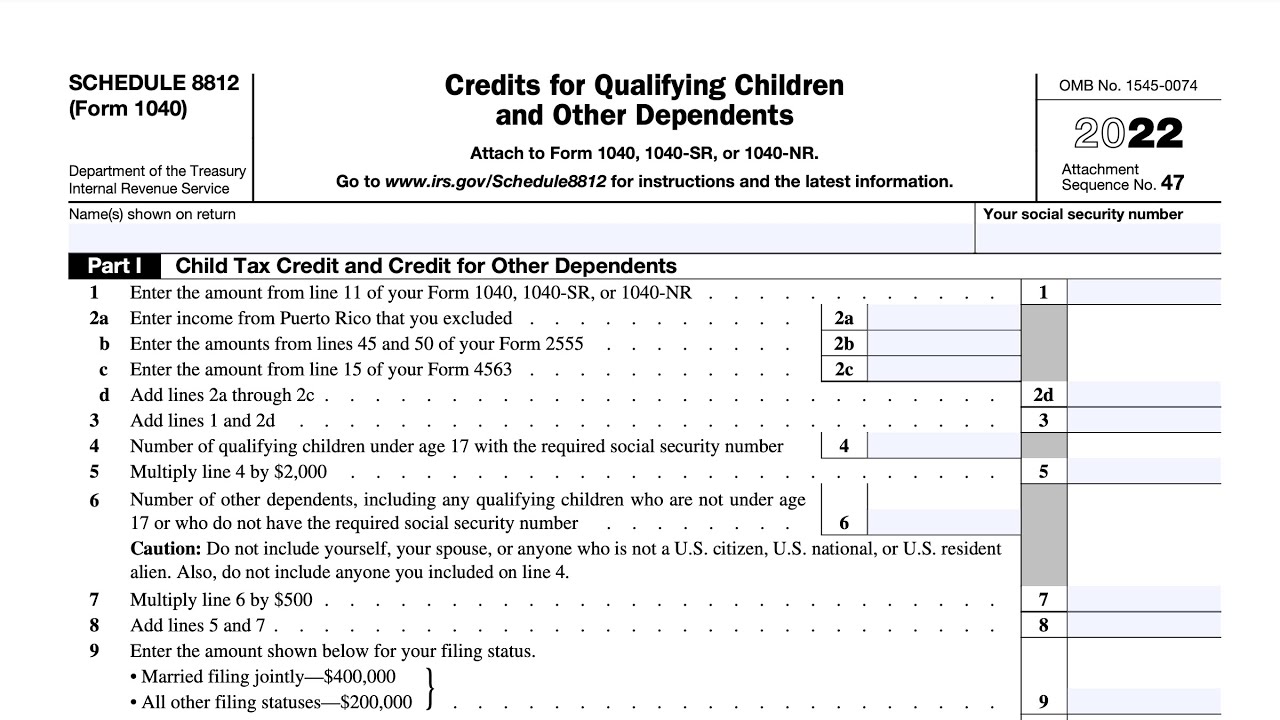

Credit Limit Worksheet 2021 - For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: $3,600 for children ages 5 and under at the. Enhanced credits for children under age 6 and under age 18 expired. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. The maximum credit can be up to $2,000 for each qualifying.

Enhanced credits for children under age 6 and under age 18 expired. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. The maximum credit can be up to $2,000 for each qualifying. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. $3,600 for children ages 5 and under at the. For tax year 2021, the child tax credit increased from $2,000 per qualifying child to:

Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. The maximum credit can be up to $2,000 for each qualifying. Enhanced credits for children under age 6 and under age 18 expired. For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. $3,600 for children ages 5 and under at the.

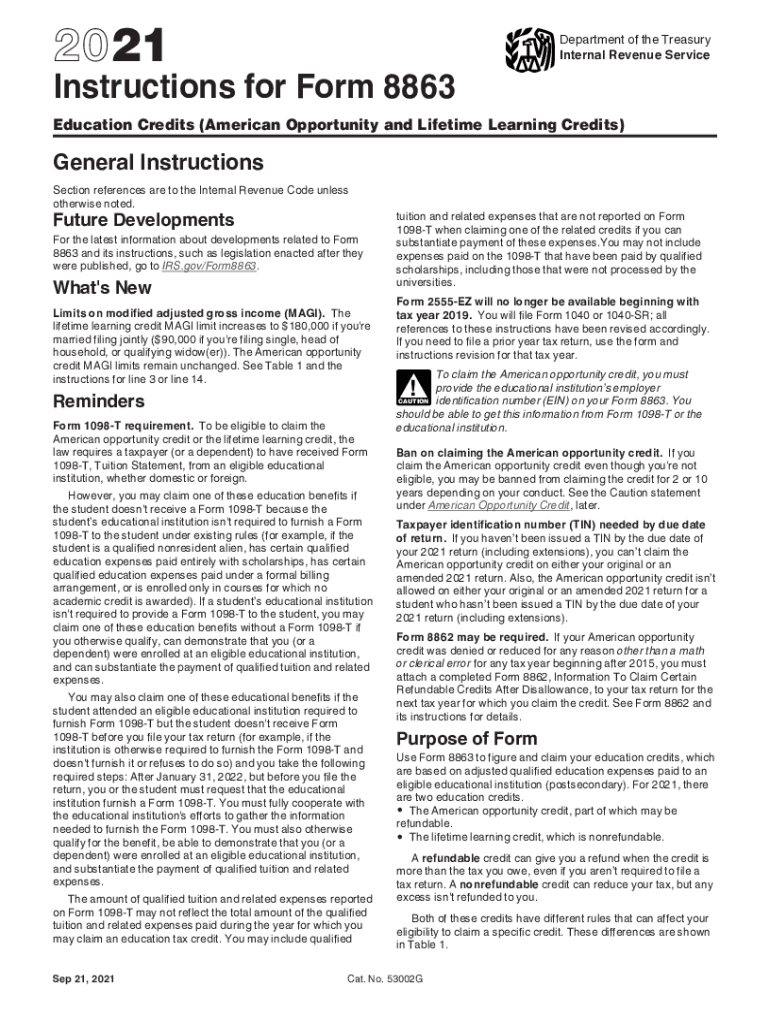

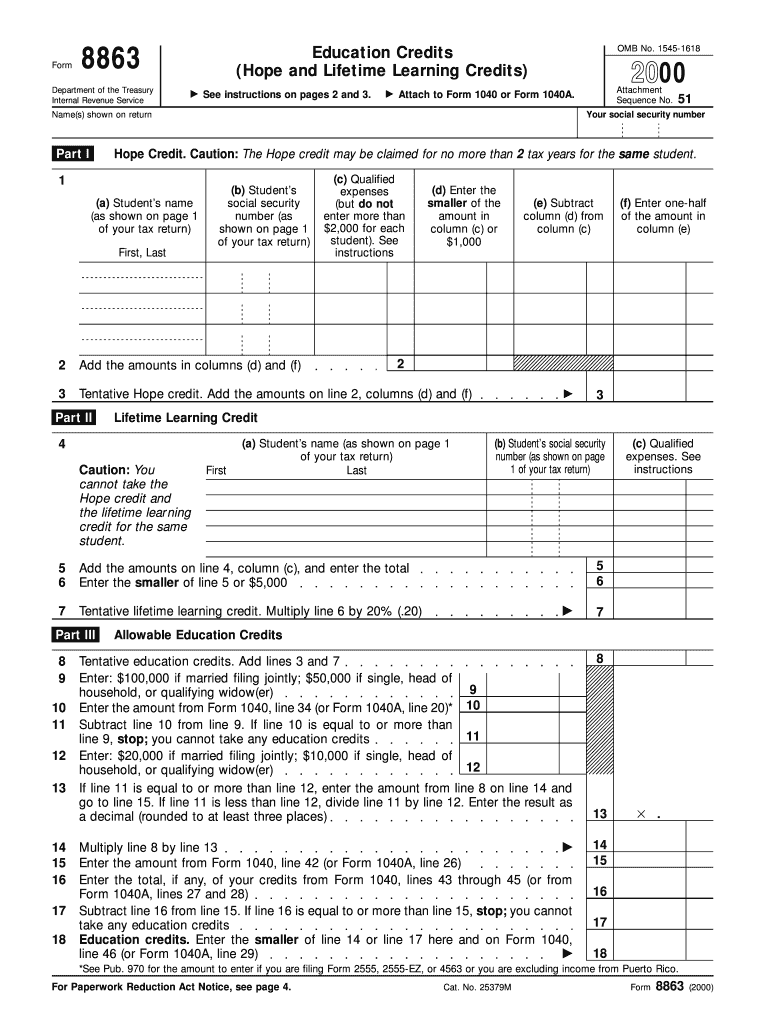

IRS Form 8863 📝 Get Federal Tax Form 8863 for 2022 Instructions

Enhanced credits for children under age 6 and under age 18 expired. For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: $3,600 for children ages 5 and under at the. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. The maximum.

Blank 8863 Credit Limit Worksheet Fill Out and Print PDFs

The maximum credit can be up to $2,000 for each qualifying. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. Enhanced credits for children under age 6 and under age 18 expired. $3,600 for children ages 5 and under at the. Complete the credit limit worksheet b.

Credit Limit Worksheet For Form 2441 Credit Limit Worksheet

For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. Enhanced credits for children under age 6 and under age 18 expired. The maximum credit can be up to $2,000 for.

2021 Form IRS Instruction 8863 Fill Online, Printable, Fillable, Blank

Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. The maximum credit can be up to $2,000 for each qualifying. For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: $3,600 for children ages 5 and under at the. Complete the credit.

Irs Credit Limit Worksheet 2021 For Form 8880

$3,600 for children ages 5 and under at the. Enhanced credits for children under age 6 and under age 18 expired. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. Complete the credit limit worksheet b only if you meet all of the following. you are claiming.

8863 Credit Limit Worksheet Form 8863education Credits

Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: The maximum credit can be up to $2,000 for each qualifying. Enhanced credits for children under age 6 and under age 18 expired..

Credit Limit Worksheet 8863

The maximum credit can be up to $2,000 for each qualifying. Enhanced credits for children under age 6 and under age 18 expired. For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the.

Child Tax Credit Limit Worksheet A 2021

The maximum credit can be up to $2,000 for each qualifying. For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: $3,600 for children ages 5 and under at the. Enhanced credits for children under age 6 and under age 18 expired. Enter the amount from line 7 of the credit limit worksheet (see instructions).

Child Tax Credit Limit Worksheet A 2021

Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. $3,600 for children ages 5 and under at the. For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: Enhanced credits for children under age 6 and under age 18 expired..

Form 8880 Credit Limit Worksheet 2021

For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following.

Enter The Amount From Line 7 Of The Credit Limit Worksheet (See Instructions) Here And On Schedule 3 (Form 1040), Line 3.

Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. The maximum credit can be up to $2,000 for each qualifying. $3,600 for children ages 5 and under at the. Enhanced credits for children under age 6 and under age 18 expired.