Depreciation On Balance Sheet Example - Web for example, if a company had $100,000 in total depreciation over the asset's expected life, and the annual depreciation was $15,000, the rate would be 15% per year. Web accumulated depreciation is the total amount of depreciation expense allocated to a specific asset since the asset was put into use. The cost for each year you own the asset becomes a business expense for that. It accounts for depreciation charged to expense for the. Web depreciation is typically tracked one of two places: On an income statement or balance sheet. For income statements, depreciation is listed as an expense. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Web the total accumulated depreciation over the asset’s lifetime is on the balance sheet.

Web accumulated depreciation is the total amount of depreciation expense allocated to a specific asset since the asset was put into use. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Web the total accumulated depreciation over the asset’s lifetime is on the balance sheet. The cost for each year you own the asset becomes a business expense for that. It accounts for depreciation charged to expense for the. Web for example, if a company had $100,000 in total depreciation over the asset's expected life, and the annual depreciation was $15,000, the rate would be 15% per year. Web depreciation is typically tracked one of two places: On an income statement or balance sheet. For income statements, depreciation is listed as an expense.

Web accumulated depreciation is the total amount of depreciation expense allocated to a specific asset since the asset was put into use. Web depreciation is typically tracked one of two places: On an income statement or balance sheet. It accounts for depreciation charged to expense for the. For income statements, depreciation is listed as an expense. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. The cost for each year you own the asset becomes a business expense for that. Web for example, if a company had $100,000 in total depreciation over the asset's expected life, and the annual depreciation was $15,000, the rate would be 15% per year. Web the total accumulated depreciation over the asset’s lifetime is on the balance sheet.

What is Accumulated Depreciation? Formula + Calculator

Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Web the total accumulated depreciation over the asset’s lifetime is on the balance sheet. Web depreciation is typically tracked one of two places: Web for example, if a company had $100,000 in total depreciation over the asset's expected.

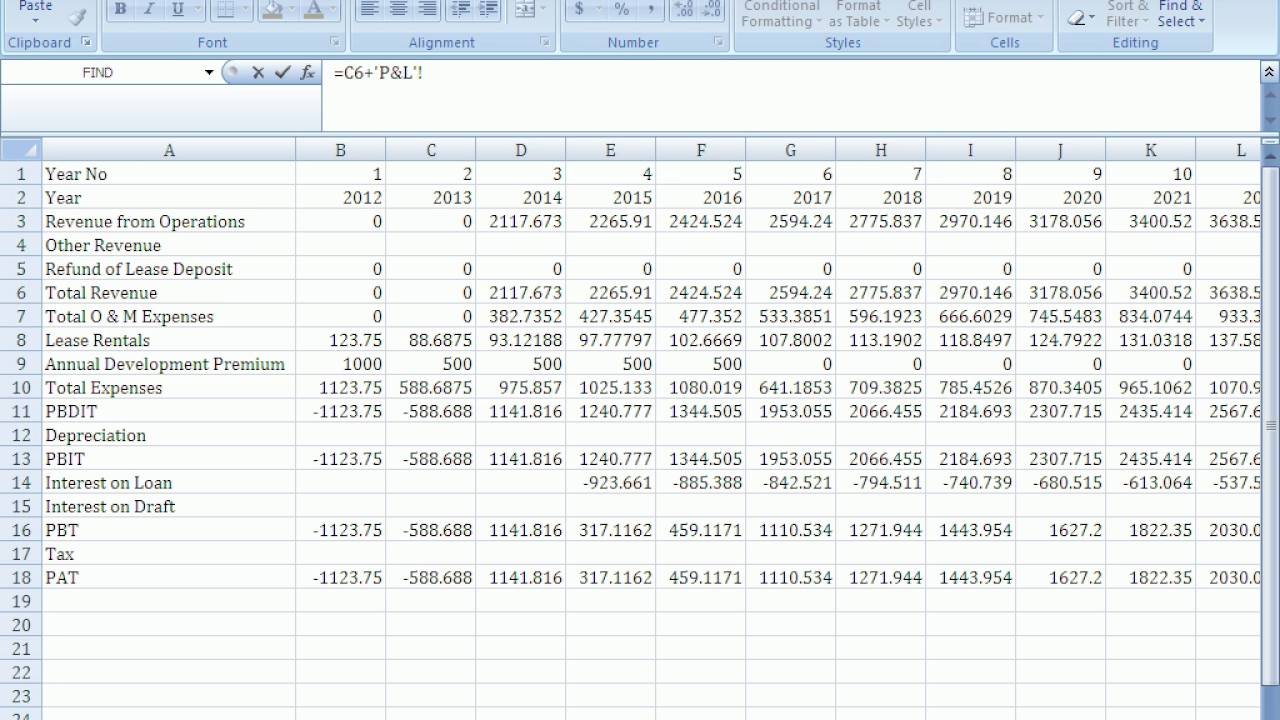

template for depreciation worksheet

Web for example, if a company had $100,000 in total depreciation over the asset's expected life, and the annual depreciation was $15,000, the rate would be 15% per year. Web the total accumulated depreciation over the asset’s lifetime is on the balance sheet. The cost for each year you own the asset becomes a business expense for that. On an.

balance sheet Expense Depreciation

Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Web the total accumulated depreciation over the asset’s lifetime is on the balance sheet. The cost for each year you own the asset becomes a business expense for that. Web depreciation is typically tracked one of two places:.

Balance Sheet Depreciation Understanding Depreciation

The cost for each year you own the asset becomes a business expense for that. For income statements, depreciation is listed as an expense. Web depreciation is typically tracked one of two places: Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. On an income statement or.

How To Calculate Depreciation Balance Sheet Haiper

It accounts for depreciation charged to expense for the. Web depreciation is typically tracked one of two places: Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. On an income statement or balance sheet. Web for example, if a company had $100,000 in total depreciation over the.

What Is Accumulated Depreciation / Why Is Accumulated Depreciation A

Web depreciation is typically tracked one of two places: It accounts for depreciation charged to expense for the. Web for example, if a company had $100,000 in total depreciation over the asset's expected life, and the annual depreciation was $15,000, the rate would be 15% per year. Web accumulated depreciation is the total decrease in the value of an asset.

Depreciation

On an income statement or balance sheet. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. The cost for each year you own the asset becomes a business expense for that. Web the total accumulated depreciation over the asset’s lifetime is on the balance sheet. For income.

8 ways to calculate depreciation in Excel Journal of Accountancy

For income statements, depreciation is listed as an expense. Web for example, if a company had $100,000 in total depreciation over the asset's expected life, and the annual depreciation was $15,000, the rate would be 15% per year. Web depreciation is typically tracked one of two places: The cost for each year you own the asset becomes a business expense.

Accumulated Depreciation Formula + Calculator

The cost for each year you own the asset becomes a business expense for that. Web accumulated depreciation is the total amount of depreciation expense allocated to a specific asset since the asset was put into use. Web for example, if a company had $100,000 in total depreciation over the asset's expected life, and the annual depreciation was $15,000, the.

Working with Balance Sheet and Depreciation YouTube

Web the total accumulated depreciation over the asset’s lifetime is on the balance sheet. Web for example, if a company had $100,000 in total depreciation over the asset's expected life, and the annual depreciation was $15,000, the rate would be 15% per year. On an income statement or balance sheet. The cost for each year you own the asset becomes.

The Cost For Each Year You Own The Asset Becomes A Business Expense For That.

For income statements, depreciation is listed as an expense. Web accumulated depreciation is the total amount of depreciation expense allocated to a specific asset since the asset was put into use. Web for example, if a company had $100,000 in total depreciation over the asset's expected life, and the annual depreciation was $15,000, the rate would be 15% per year. Web the total accumulated depreciation over the asset’s lifetime is on the balance sheet.

Web Depreciation Is Typically Tracked One Of Two Places:

On an income statement or balance sheet. Web accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. It accounts for depreciation charged to expense for the.