Form 8812 Line 5 Worksheet - If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. In the meantime, i decided to fill out the forms via paper as an educational exercise. Qualifying families with incomes less than $75,000 for single, $112,500 for head.

If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. Qualifying families with incomes less than $75,000 for single, $112,500 for head. In the meantime, i decided to fill out the forms via paper as an educational exercise.

In the meantime, i decided to fill out the forms via paper as an educational exercise. Qualifying families with incomes less than $75,000 for single, $112,500 for head. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this.

Line 5 Worksheet Form 8812 2021

If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. Qualifying families with incomes less than $75,000 for single, $112,500 for head. In the meantime, i decided to fill out the forms via paper as an educational exercise.

Irs Form 8812 2021 Line 5 Worksheet

If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. Qualifying families with incomes less than $75,000 for single, $112,500 for head. In the meantime, i decided to fill out the forms via paper as an educational exercise.

Schedule 8812 2022 for Child Tax Credit File Online Schedules TaxUni

In the meantime, i decided to fill out the forms via paper as an educational exercise. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. Qualifying families with incomes less than $75,000 for single, $112,500 for head.

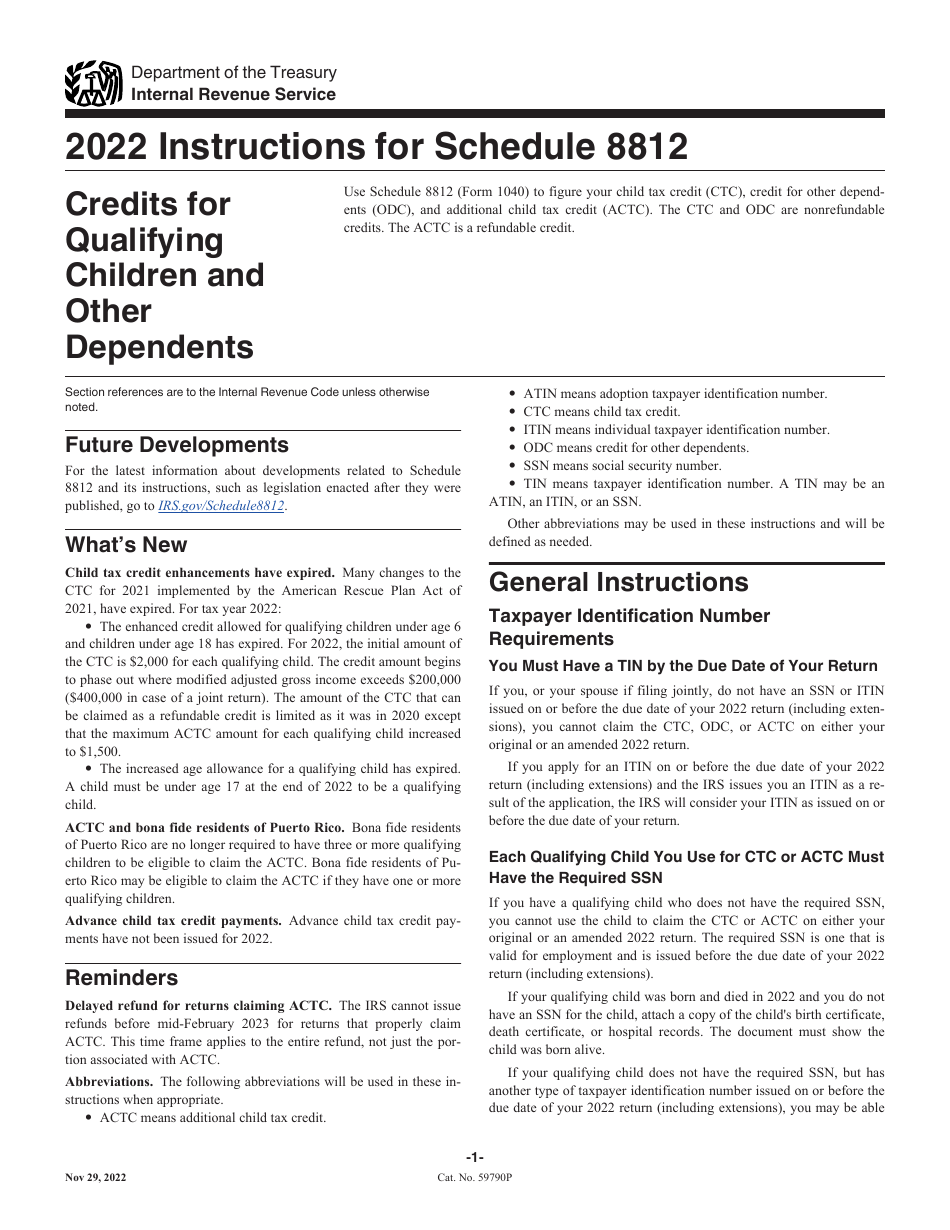

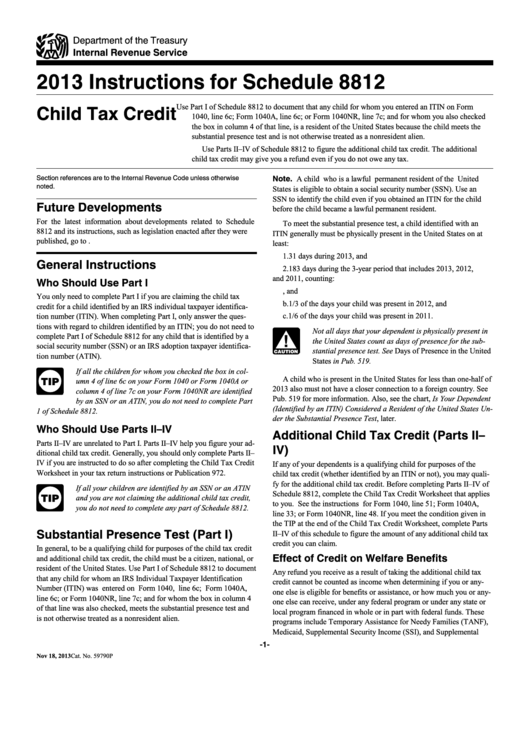

Download Instructions for IRS Form 1040 Schedule 8812 Credits for

Qualifying families with incomes less than $75,000 for single, $112,500 for head. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. In the meantime, i decided to fill out the forms via paper as an educational exercise.

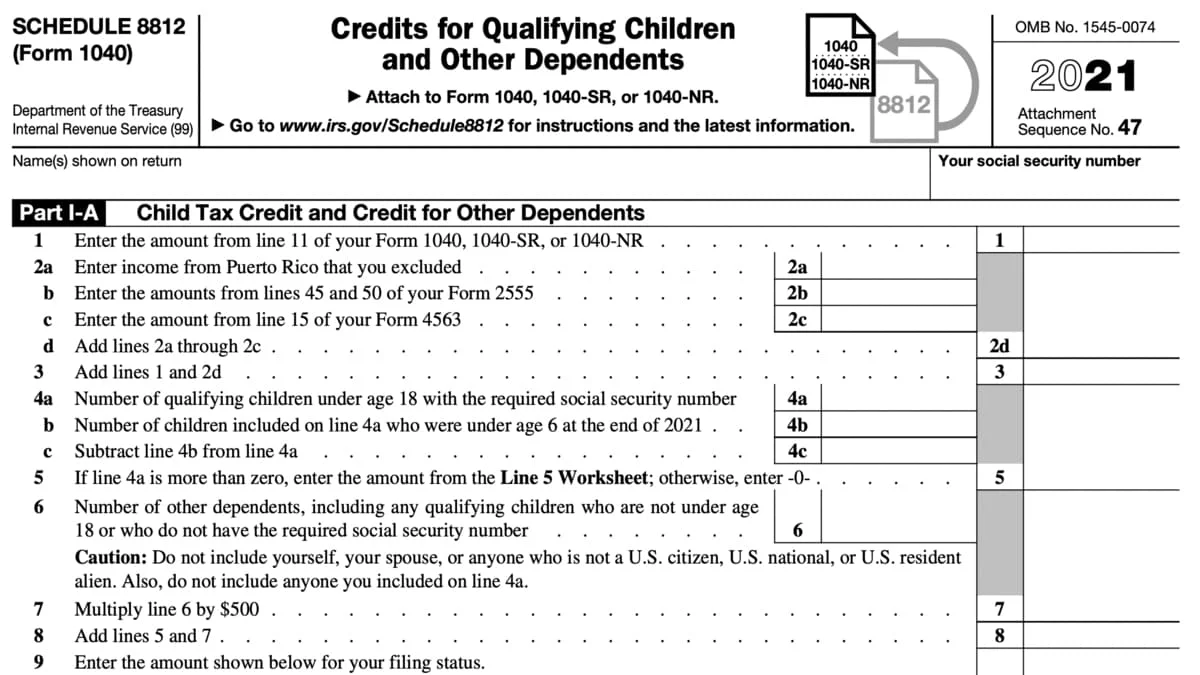

IRS Form 1040 Schedule 8812 (2021) Credits for Qualifying Children

Qualifying families with incomes less than $75,000 for single, $112,500 for head. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. In the meantime, i decided to fill out the forms via paper as an educational exercise.

2021 Line 5 Worksheet Form 8812

Qualifying families with incomes less than $75,000 for single, $112,500 for head. In the meantime, i decided to fill out the forms via paper as an educational exercise. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this.

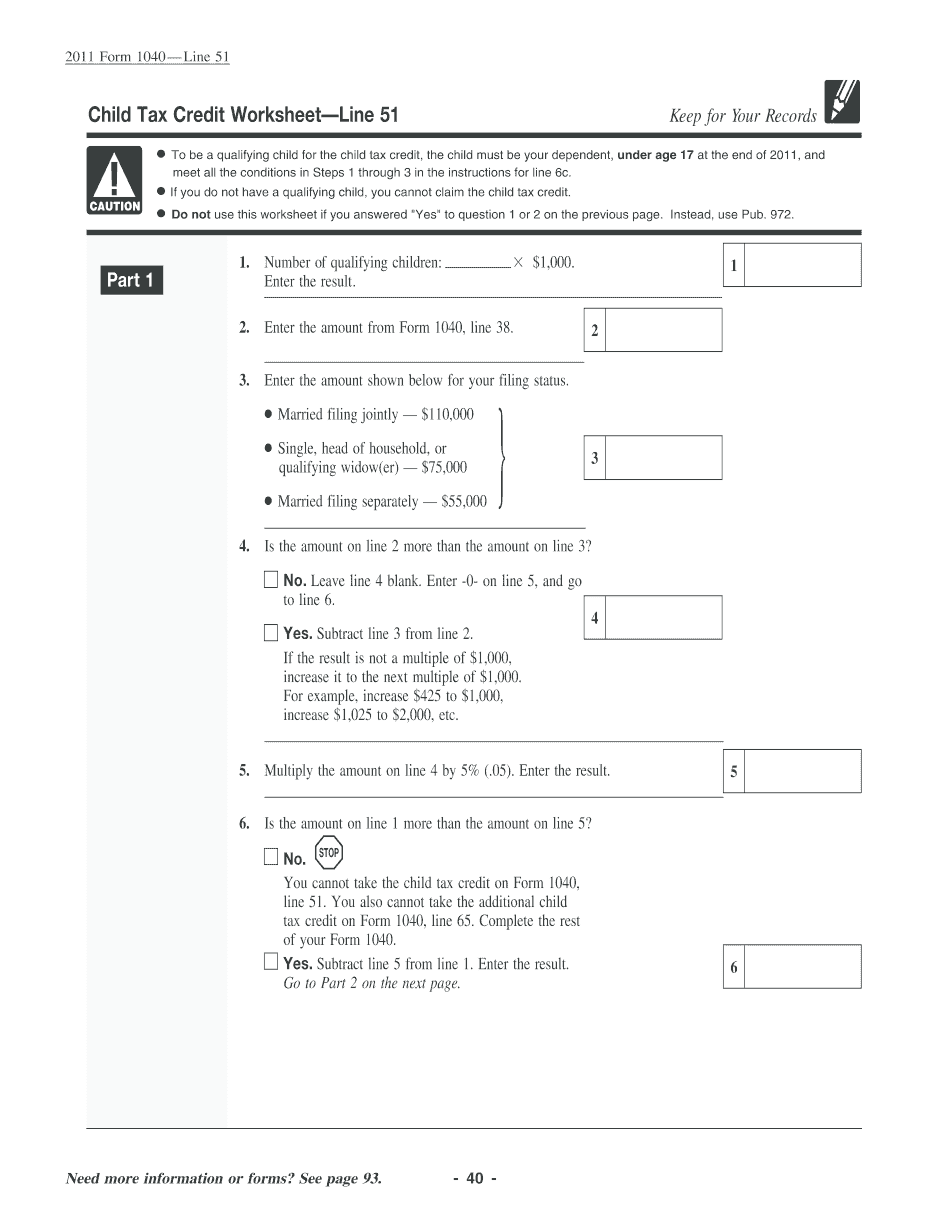

Form 8812 Line 5 Worksheet

Qualifying families with incomes less than $75,000 for single, $112,500 for head. In the meantime, i decided to fill out the forms via paper as an educational exercise. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this.

Child Tax Credit Limit Worksheet A 2021

If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. Qualifying families with incomes less than $75,000 for single, $112,500 for head. In the meantime, i decided to fill out the forms via paper as an educational exercise.

Fillable Schedule 8812 (Form 1040a Or 1040) Child Tax Credit 2016

Qualifying families with incomes less than $75,000 for single, $112,500 for head. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. In the meantime, i decided to fill out the forms via paper as an educational exercise.

Download Instructions for IRS Form 1040 Schedule 8812 Credits for

Qualifying families with incomes less than $75,000 for single, $112,500 for head. In the meantime, i decided to fill out the forms via paper as an educational exercise. If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this.

In The Meantime, I Decided To Fill Out The Forms Via Paper As An Educational Exercise.

If your employer withheld or you paid additional medicare tax or tier 1 rrta taxes, use this. Qualifying families with incomes less than $75,000 for single, $112,500 for head.