Negative Liability On Balance Sheet - The following will illustrate why a negative cash balance is reported as a liability instead of being reported as a negative asset amount. There is no opening balance, all loan payments were recorded. If only one liability account has a negative sign, it is likely that the liability. Web a negative liability typically appears on the balance sheet when a company pays out more than the amount required by a liability. Web if the liability account is negative, there are 2 situations: Web why is a negative cash balance reported as a liability? For example, if you were to accidentally pay a supplier's. Web the accounting software usually had an option to print the liability account balances on the balance sheet without the negative signs.

Web a negative liability typically appears on the balance sheet when a company pays out more than the amount required by a liability. Web why is a negative cash balance reported as a liability? Web if the liability account is negative, there are 2 situations: There is no opening balance, all loan payments were recorded. Web the accounting software usually had an option to print the liability account balances on the balance sheet without the negative signs. The following will illustrate why a negative cash balance is reported as a liability instead of being reported as a negative asset amount. For example, if you were to accidentally pay a supplier's. If only one liability account has a negative sign, it is likely that the liability.

If only one liability account has a negative sign, it is likely that the liability. The following will illustrate why a negative cash balance is reported as a liability instead of being reported as a negative asset amount. There is no opening balance, all loan payments were recorded. For example, if you were to accidentally pay a supplier's. Web if the liability account is negative, there are 2 situations: Web the accounting software usually had an option to print the liability account balances on the balance sheet without the negative signs. Web a negative liability typically appears on the balance sheet when a company pays out more than the amount required by a liability. Web why is a negative cash balance reported as a liability?

Understanding Negative Balances in Your Financial Statements Fortiviti

For example, if you were to accidentally pay a supplier's. Web the accounting software usually had an option to print the liability account balances on the balance sheet without the negative signs. The following will illustrate why a negative cash balance is reported as a liability instead of being reported as a negative asset amount. Web why is a negative.

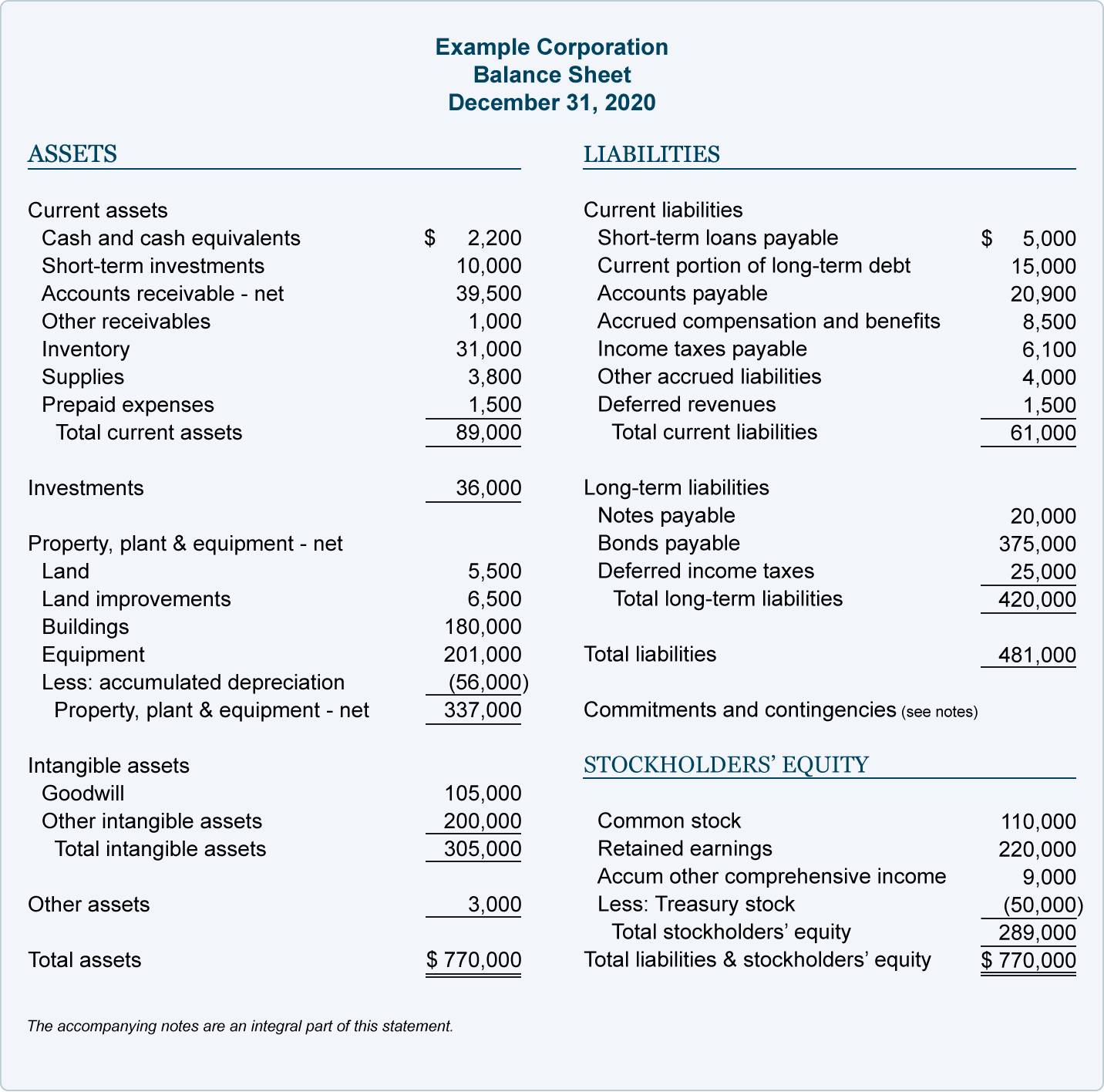

Negative Liability on Balance Sheet

There is no opening balance, all loan payments were recorded. Web if the liability account is negative, there are 2 situations: Web a negative liability typically appears on the balance sheet when a company pays out more than the amount required by a liability. Web the accounting software usually had an option to print the liability account balances on the.

The Importance of an Accurate Balance Sheet Basis 365 Accounting

If only one liability account has a negative sign, it is likely that the liability. The following will illustrate why a negative cash balance is reported as a liability instead of being reported as a negative asset amount. Web if the liability account is negative, there are 2 situations: There is no opening balance, all loan payments were recorded. Web.

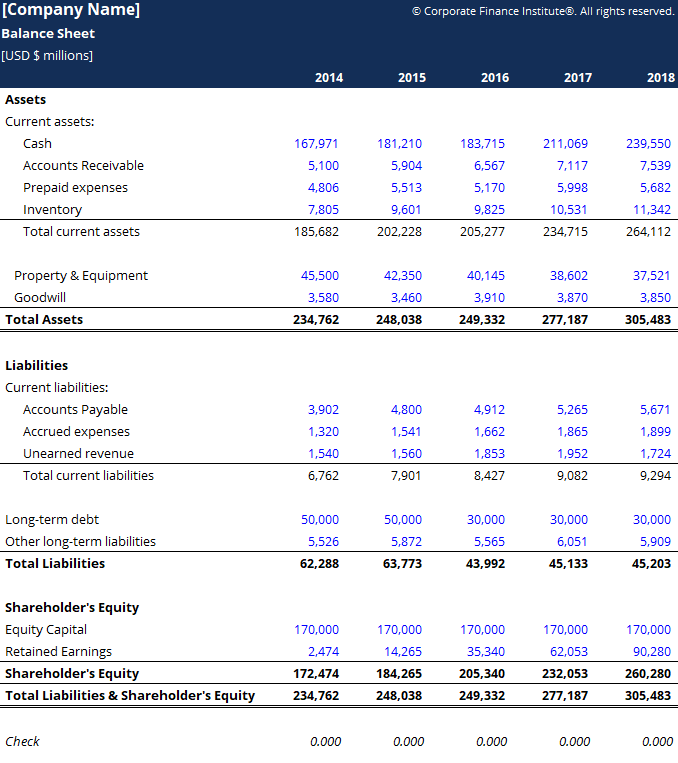

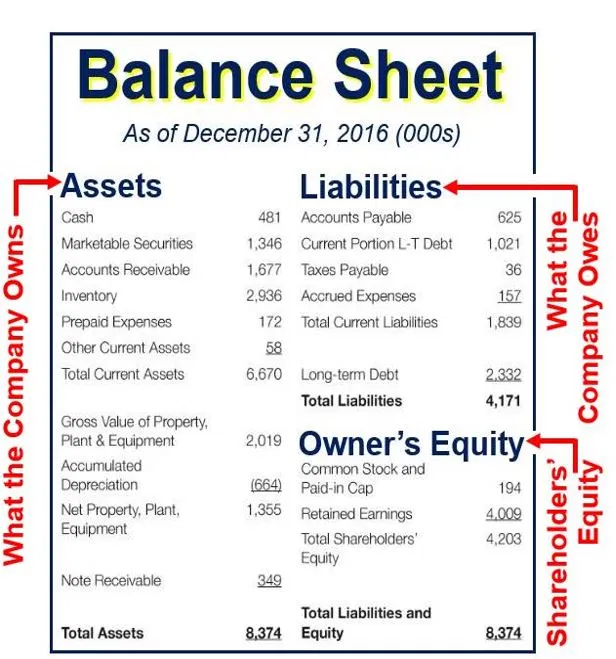

Balance Sheet — CFOPRO

For example, if you were to accidentally pay a supplier's. Web the accounting software usually had an option to print the liability account balances on the balance sheet without the negative signs. If only one liability account has a negative sign, it is likely that the liability. Web if the liability account is negative, there are 2 situations: Web a.

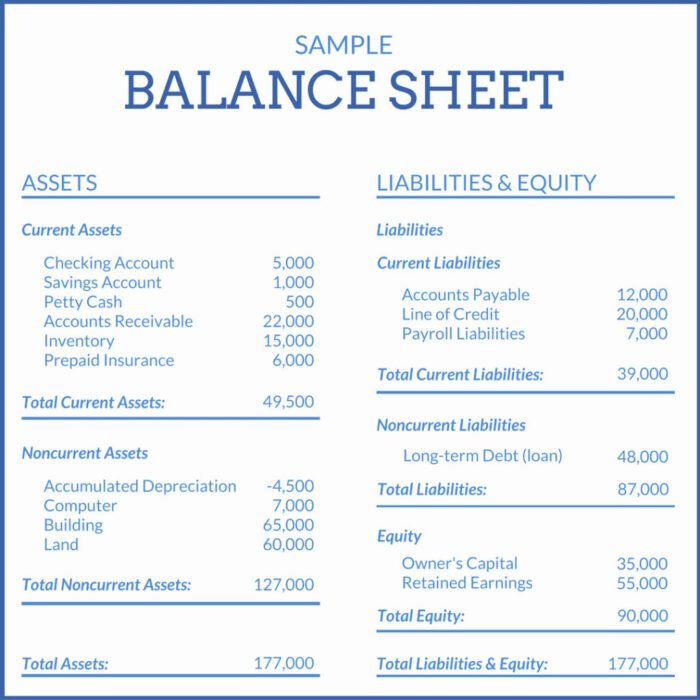

Balance Sheet Template Free Sheet Templates

There is no opening balance, all loan payments were recorded. Web why is a negative cash balance reported as a liability? Web the accounting software usually had an option to print the liability account balances on the balance sheet without the negative signs. For example, if you were to accidentally pay a supplier's. Web if the liability account is negative,.

Bookkeeping To Trial Balance Example Of Deferred Tax Liability

If only one liability account has a negative sign, it is likely that the liability. There is no opening balance, all loan payments were recorded. Web the accounting software usually had an option to print the liability account balances on the balance sheet without the negative signs. Web a negative liability typically appears on the balance sheet when a company.

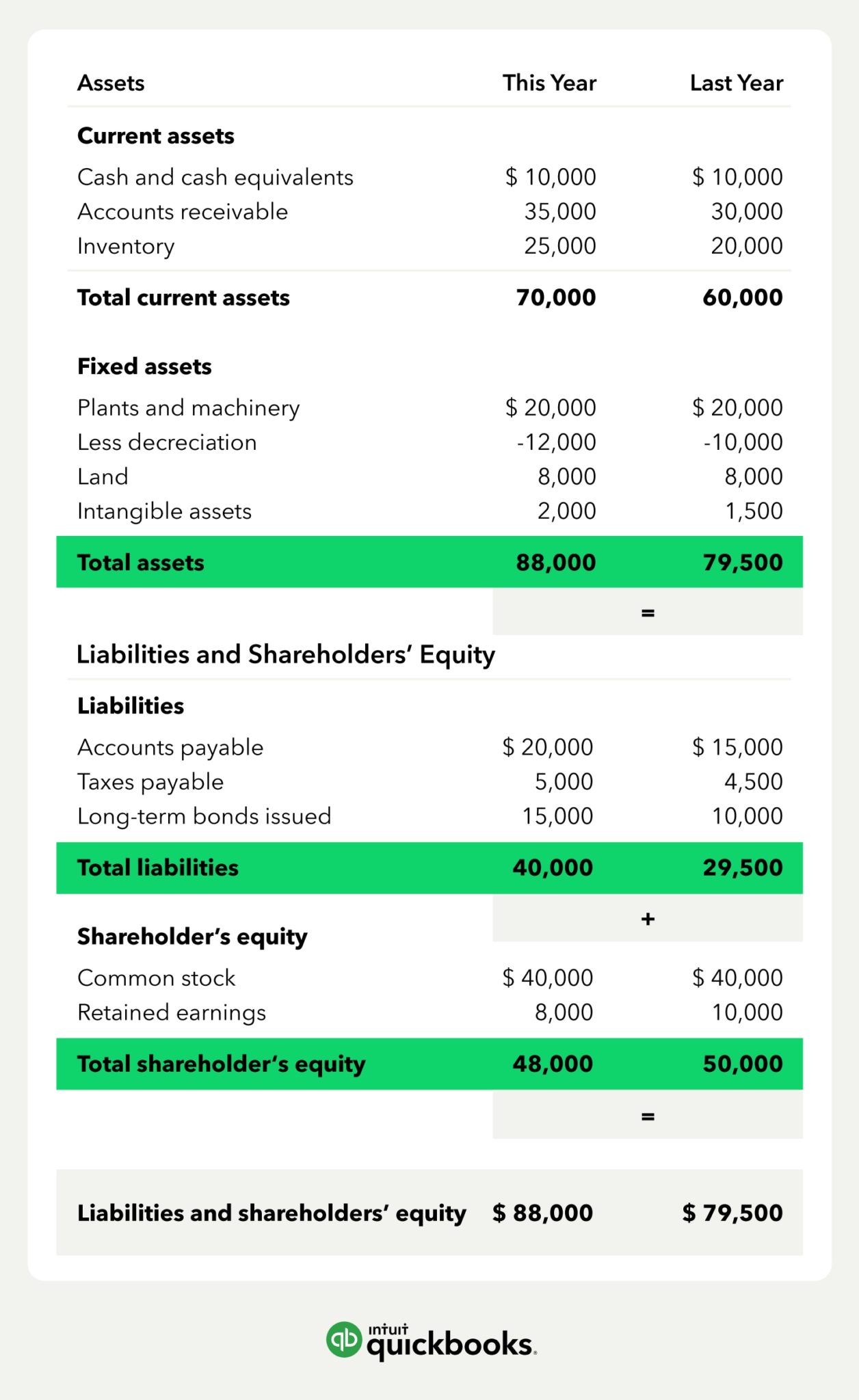

What is balance sheet? Definition, example, explanation

The following will illustrate why a negative cash balance is reported as a liability instead of being reported as a negative asset amount. Web the accounting software usually had an option to print the liability account balances on the balance sheet without the negative signs. Web a negative liability typically appears on the balance sheet when a company pays out.

Liabilities How to classify, Track and calculate liabilities?

Web a negative liability typically appears on the balance sheet when a company pays out more than the amount required by a liability. Web if the liability account is negative, there are 2 situations: There is no opening balance, all loan payments were recorded. For example, if you were to accidentally pay a supplier's. If only one liability account has.

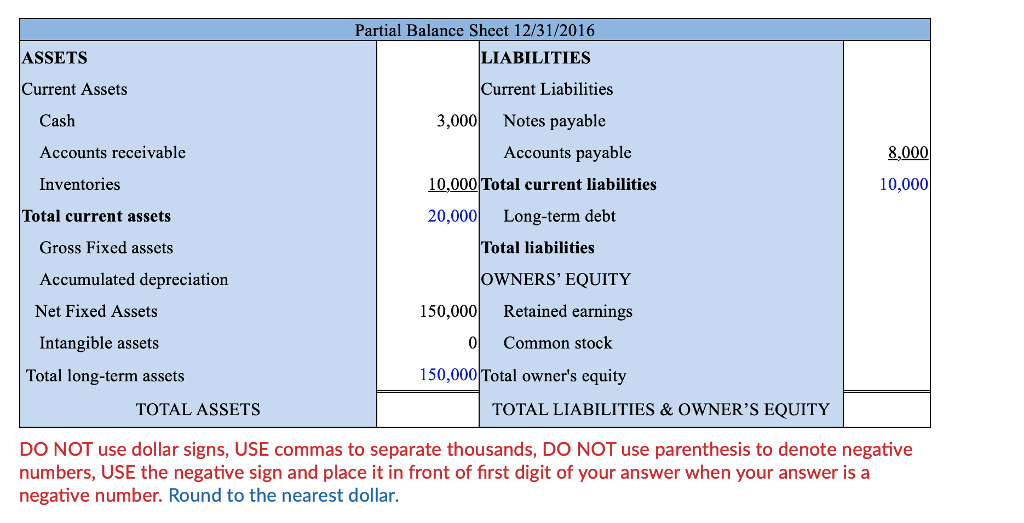

Solved Balance sheet. Use the data from the financial

There is no opening balance, all loan payments were recorded. Web a negative liability typically appears on the balance sheet when a company pays out more than the amount required by a liability. Web if the liability account is negative, there are 2 situations: Web the accounting software usually had an option to print the liability account balances on the.

Net Operating Losses & Deferred Tax Assets Tutorial

Web why is a negative cash balance reported as a liability? For example, if you were to accidentally pay a supplier's. Web the accounting software usually had an option to print the liability account balances on the balance sheet without the negative signs. There is no opening balance, all loan payments were recorded. Web if the liability account is negative,.

Web A Negative Liability Typically Appears On The Balance Sheet When A Company Pays Out More Than The Amount Required By A Liability.

For example, if you were to accidentally pay a supplier's. Web why is a negative cash balance reported as a liability? There is no opening balance, all loan payments were recorded. Web the accounting software usually had an option to print the liability account balances on the balance sheet without the negative signs.

Web If The Liability Account Is Negative, There Are 2 Situations:

If only one liability account has a negative sign, it is likely that the liability. The following will illustrate why a negative cash balance is reported as a liability instead of being reported as a negative asset amount.