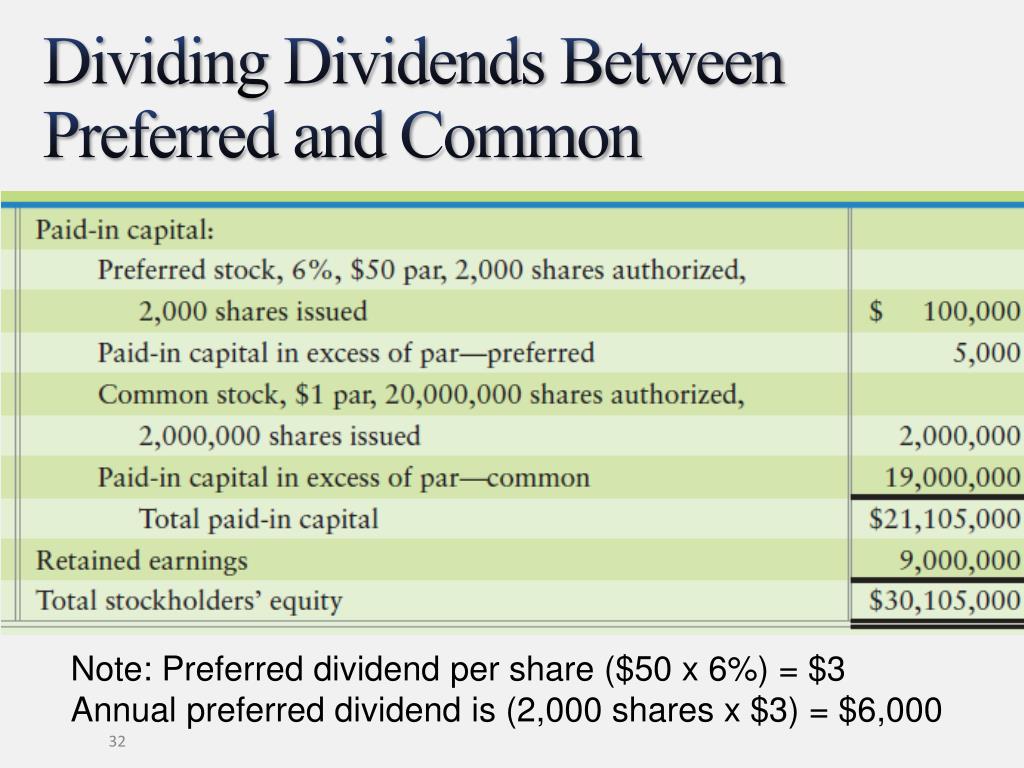

Preferred Dividends On Balance Sheet - The cash flow statement would show $9 million in dividends distributed. Web the income statement would show $10 million, and the balance sheet would show $1 million. Read more by the company to raise capital in the primary and secondary markets. Web the total value of the dividend is $0.50 x 500,000, or $250,000, to be paid to shareholders. Web a preferred dividend is a dividend that is allocated to and paid on a company's preferred shares. As a result, both cash and retained earnings are reduced by $250,000 leaving $750,000 remaining in. Web they are recorded as owner's equity on the company's balance sheet. If a company is unable to pay all dividends, claims to preferred dividends take. The preferred stock pays a fixed percentage of. Web multiply the percentage (if no dollar value is stated) by the par value of preferred stock to calculate a dollar value of dividends due for each share.

For example, a 4 percent dividend on preferred stock with. Web a preferred dividend is a dividend that is allocated to and paid on a company's preferred shares. Web they are recorded as owner's equity on the company's balance sheet. Read more by the company to raise capital in the primary and secondary markets. The preferred stock pays a fixed percentage of. The cash flow statement would show $9 million in dividends distributed. Web the income statement would show $10 million, and the balance sheet would show $1 million. If a company is unable to pay all dividends, claims to preferred dividends take. Web multiply the percentage (if no dollar value is stated) by the par value of preferred stock to calculate a dollar value of dividends due for each share. Web the total value of the dividend is $0.50 x 500,000, or $250,000, to be paid to shareholders.

Web the income statement would show $10 million, and the balance sheet would show $1 million. The preferred stock pays a fixed percentage of. For example, a 4 percent dividend on preferred stock with. Read more by the company to raise capital in the primary and secondary markets. Web multiply the percentage (if no dollar value is stated) by the par value of preferred stock to calculate a dollar value of dividends due for each share. Web a preferred dividend is a dividend that is allocated to and paid on a company's preferred shares. If a company is unable to pay all dividends, claims to preferred dividends take. The cash flow statement would show $9 million in dividends distributed. As a result, both cash and retained earnings are reduced by $250,000 leaving $750,000 remaining in. Web the total value of the dividend is $0.50 x 500,000, or $250,000, to be paid to shareholders.

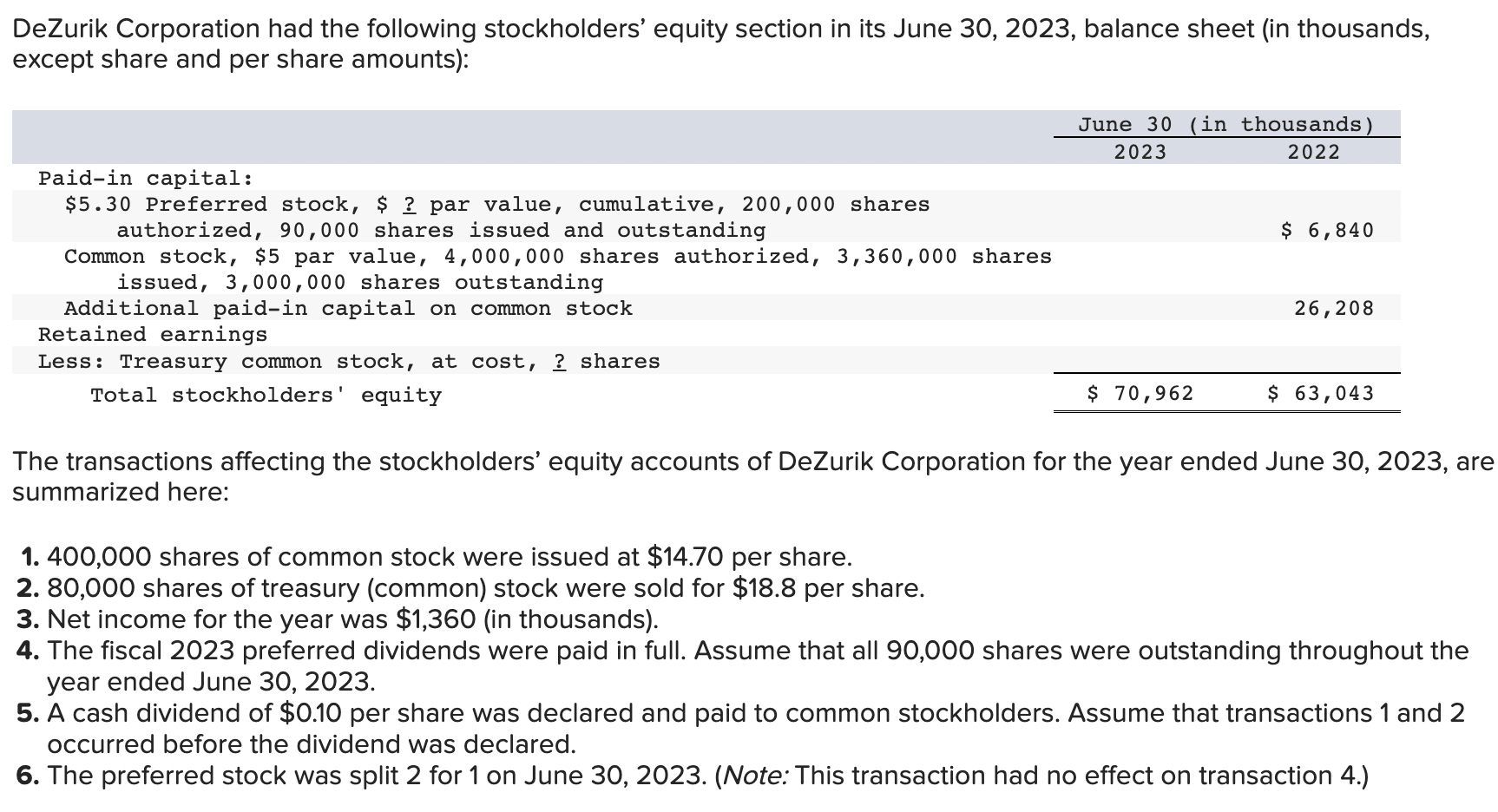

Solved DeZurik Corporation had the following stockholders’

The cash flow statement would show $9 million in dividends distributed. If a company is unable to pay all dividends, claims to preferred dividends take. Web multiply the percentage (if no dollar value is stated) by the par value of preferred stock to calculate a dollar value of dividends due for each share. Web the total value of the dividend.

Solved HEADLAND CORPORATION POSTCLOSING TRIAL BALANCE

The cash flow statement would show $9 million in dividends distributed. Web they are recorded as owner's equity on the company's balance sheet. The preferred stock pays a fixed percentage of. Read more by the company to raise capital in the primary and secondary markets. Web a preferred dividend is a dividend that is allocated to and paid on a.

2 Tandy Company was issued a charter by the state of Indiana on January

Web multiply the percentage (if no dollar value is stated) by the par value of preferred stock to calculate a dollar value of dividends due for each share. The preferred stock pays a fixed percentage of. As a result, both cash and retained earnings are reduced by $250,000 leaving $750,000 remaining in. Read more by the company to raise capital.

Eligible Dividends

Read more by the company to raise capital in the primary and secondary markets. If a company is unable to pay all dividends, claims to preferred dividends take. Web a preferred dividend is a dividend that is allocated to and paid on a company's preferred shares. Web they are recorded as owner's equity on the company's balance sheet. As a.

Cost of Preferred Stock (kp) Formula + Calculator

Read more by the company to raise capital in the primary and secondary markets. As a result, both cash and retained earnings are reduced by $250,000 leaving $750,000 remaining in. The preferred stock pays a fixed percentage of. If a company is unable to pay all dividends, claims to preferred dividends take. Web multiply the percentage (if no dollar value.

Dividend Recap LBO Tutorial With Excel Examples

The preferred stock pays a fixed percentage of. Read more by the company to raise capital in the primary and secondary markets. Web multiply the percentage (if no dollar value is stated) by the par value of preferred stock to calculate a dollar value of dividends due for each share. As a result, both cash and retained earnings are reduced.

Dividend Recap LBO Tutorial With Excel Examples

The cash flow statement would show $9 million in dividends distributed. Web they are recorded as owner's equity on the company's balance sheet. For example, a 4 percent dividend on preferred stock with. Web a preferred dividend is a dividend that is allocated to and paid on a company's preferred shares. As a result, both cash and retained earnings are.

What is share capital BDC.ca

The cash flow statement would show $9 million in dividends distributed. As a result, both cash and retained earnings are reduced by $250,000 leaving $750,000 remaining in. Web they are recorded as owner's equity on the company's balance sheet. Web multiply the percentage (if no dollar value is stated) by the par value of preferred stock to calculate a dollar.

the balance sheet for tactex controls inc provincially incorporated in

Web they are recorded as owner's equity on the company's balance sheet. Web multiply the percentage (if no dollar value is stated) by the par value of preferred stock to calculate a dollar value of dividends due for each share. For example, a 4 percent dividend on preferred stock with. Web the income statement would show $10 million, and the.

balance sheet example dividends DriverLayer Search Engine

The cash flow statement would show $9 million in dividends distributed. Web the total value of the dividend is $0.50 x 500,000, or $250,000, to be paid to shareholders. Web the income statement would show $10 million, and the balance sheet would show $1 million. Web a preferred dividend is a dividend that is allocated to and paid on a.

As A Result, Both Cash And Retained Earnings Are Reduced By $250,000 Leaving $750,000 Remaining In.

If a company is unable to pay all dividends, claims to preferred dividends take. Web the total value of the dividend is $0.50 x 500,000, or $250,000, to be paid to shareholders. Web the income statement would show $10 million, and the balance sheet would show $1 million. The cash flow statement would show $9 million in dividends distributed.

Web Multiply The Percentage (If No Dollar Value Is Stated) By The Par Value Of Preferred Stock To Calculate A Dollar Value Of Dividends Due For Each Share.

Read more by the company to raise capital in the primary and secondary markets. For example, a 4 percent dividend on preferred stock with. Web they are recorded as owner's equity on the company's balance sheet. Web a preferred dividend is a dividend that is allocated to and paid on a company's preferred shares.