Self Employment Tax Deductions Worksheet - Tax pros on standbytax filing included For your business to be deductible.) did. 4.5/5 (13k) A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Use a separate worksheet for each business owned/operated.

For your business to be deductible.) did. 4.5/5 (13k) A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Use a separate worksheet for each business owned/operated. Tax pros on standbytax filing included

4.5/5 (13k) For your business to be deductible.) did. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Use a separate worksheet for each business owned/operated. Tax pros on standbytax filing included

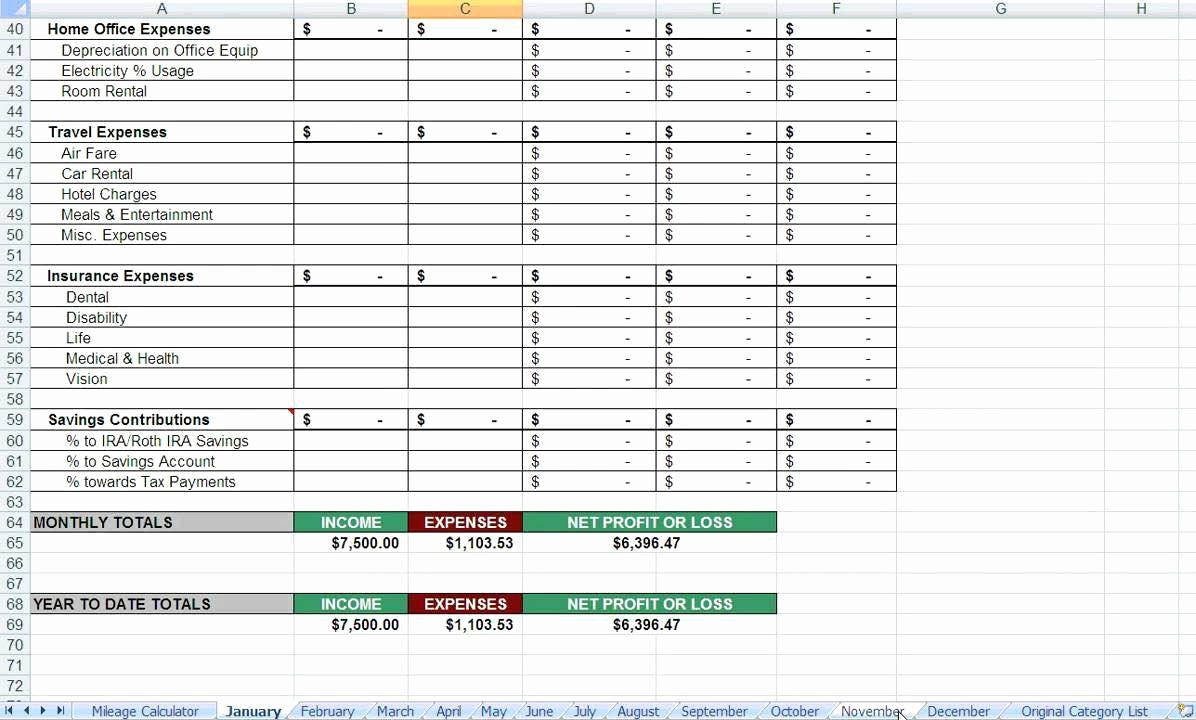

Self Employed Spreadsheet And 25 Fresh Self Employed Tax —

Use a separate worksheet for each business owned/operated. 4.5/5 (13k) Tax pros on standbytax filing included For your business to be deductible.) did. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements.

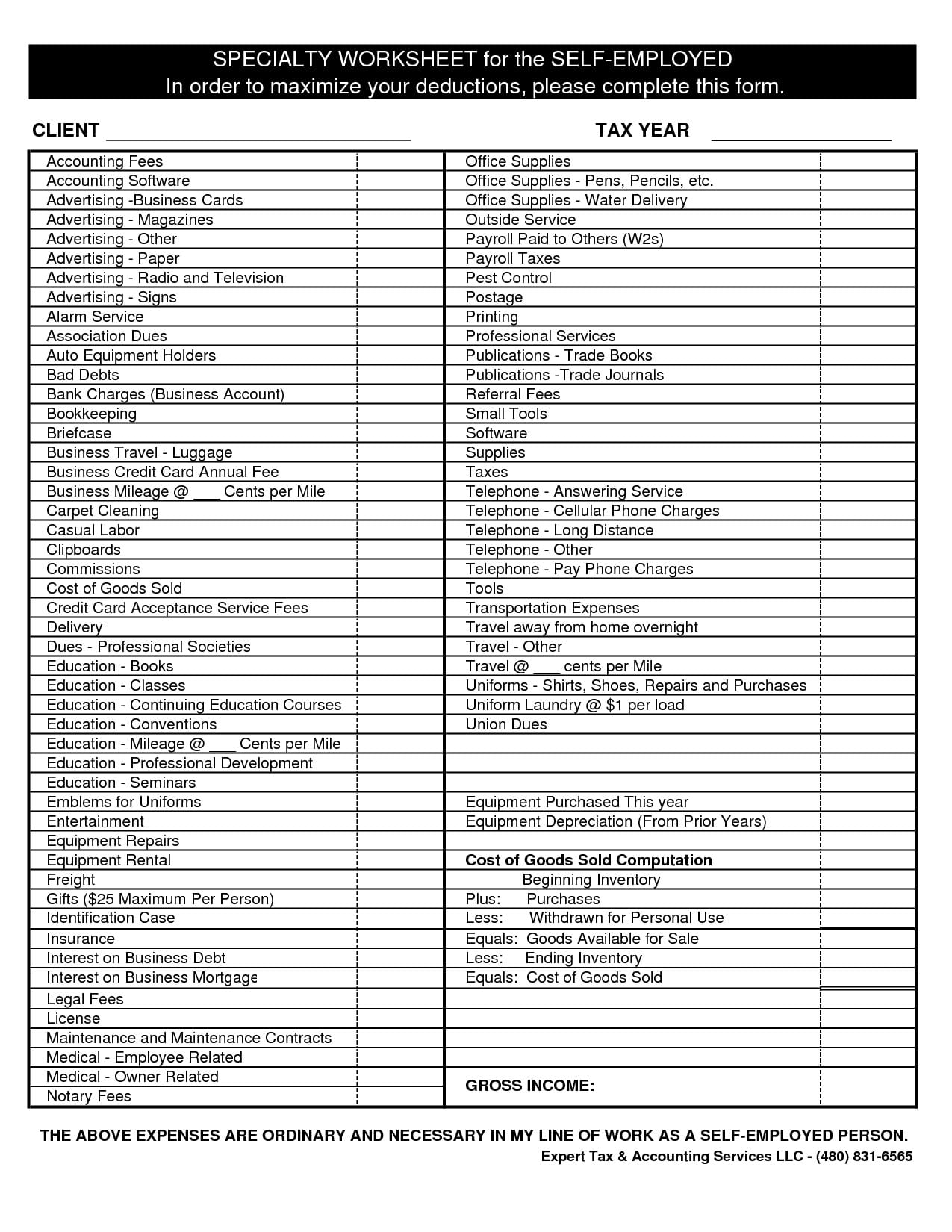

Printable Self Employed Tax Deductions Worksheet Small Busin

A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. For your business to be deductible.) did. Tax pros on standbytax filing included 4.5/5 (13k) Use a separate worksheet for each business owned/operated.

How to File SelfEmployment Taxes, Step by Step Your Guide

For your business to be deductible.) did. Tax pros on standbytax filing included Use a separate worksheet for each business owned/operated. 4.5/5 (13k) A collection of relevant forms and publications related to understanding and fulfilling your filing requirements.

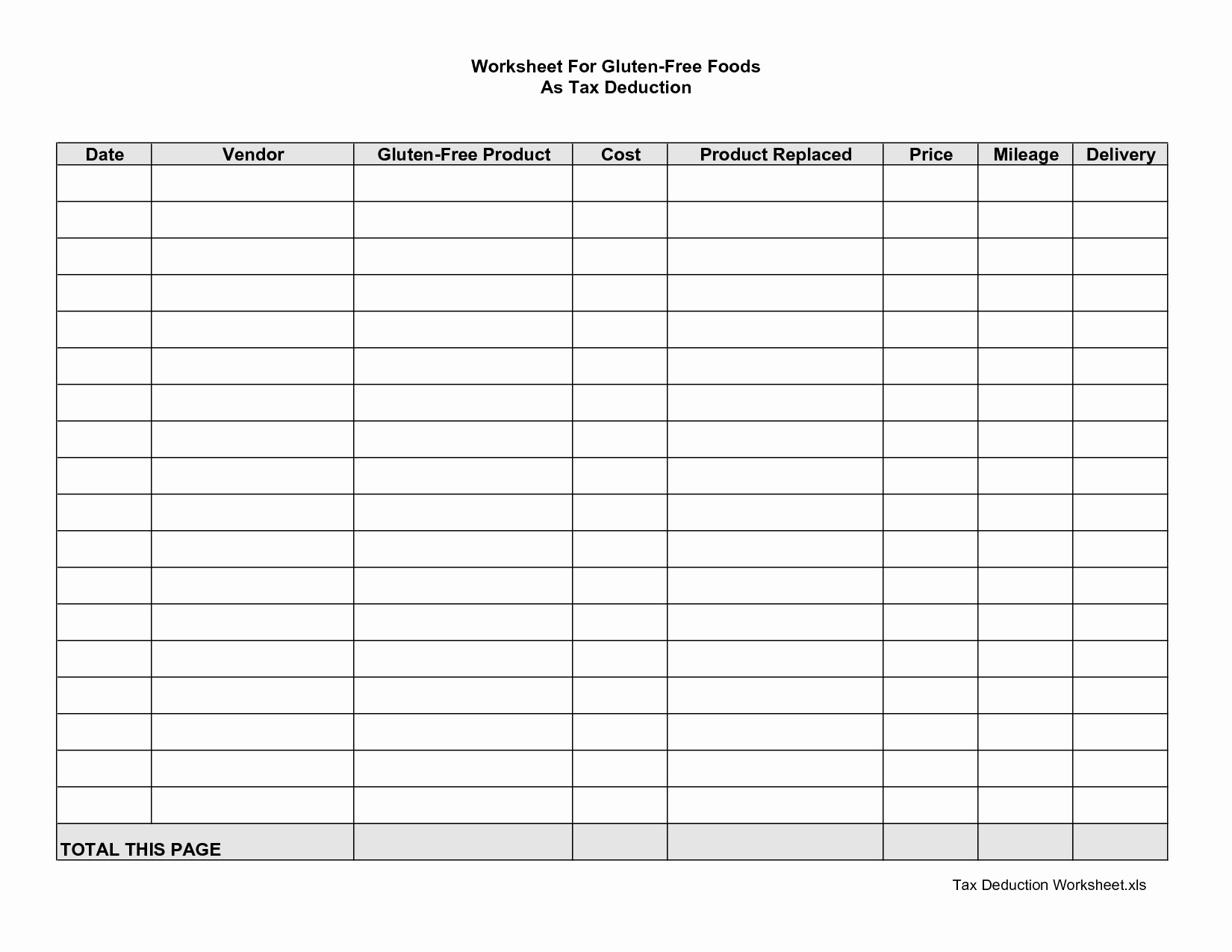

Self Employed Tax Deductions Worksheet

Use a separate worksheet for each business owned/operated. Tax pros on standbytax filing included A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. For your business to be deductible.) did. 4.5/5 (13k)

2017 Self Employment Tax And Deduction Worksheet —

Use a separate worksheet for each business owned/operated. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Tax pros on standbytax filing included 4.5/5 (13k) For your business to be deductible.) did.

Self Employed Tax Deductions Worksheet Small Business Tax De

Use a separate worksheet for each business owned/operated. 4.5/5 (13k) A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. For your business to be deductible.) did. Tax pros on standbytax filing included

Tax Deduction Worksheet For Self Employed

Use a separate worksheet for each business owned/operated. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. 4.5/5 (13k) Tax pros on standbytax filing included For your business to be deductible.) did.

Self Employed Tax Spreadsheet with regard to Tax Deduction

Use a separate worksheet for each business owned/operated. For your business to be deductible.) did. 4.5/5 (13k) A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Tax pros on standbytax filing included

Self Employment Printable Small Business Tax Deductions Work

A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Tax pros on standbytax filing included 4.5/5 (13k) For your business to be deductible.) did. Use a separate worksheet for each business owned/operated.

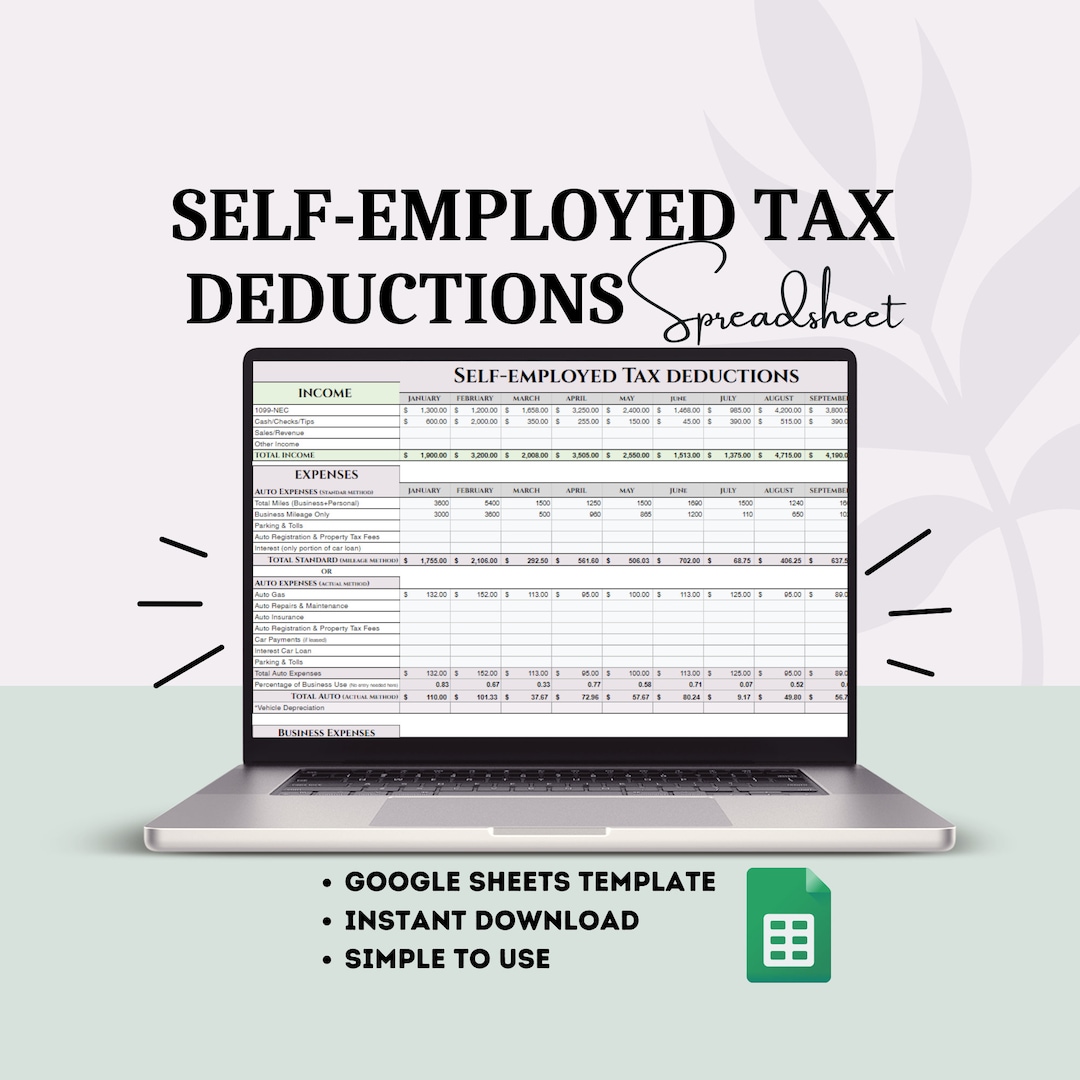

Selfemployed Tax Deductions Small Business Expense Tracker Startup

For your business to be deductible.) did. Tax pros on standbytax filing included Use a separate worksheet for each business owned/operated. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. 4.5/5 (13k)

A Collection Of Relevant Forms And Publications Related To Understanding And Fulfilling Your Filing Requirements.

Tax pros on standbytax filing included Use a separate worksheet for each business owned/operated. 4.5/5 (13k) For your business to be deductible.) did.