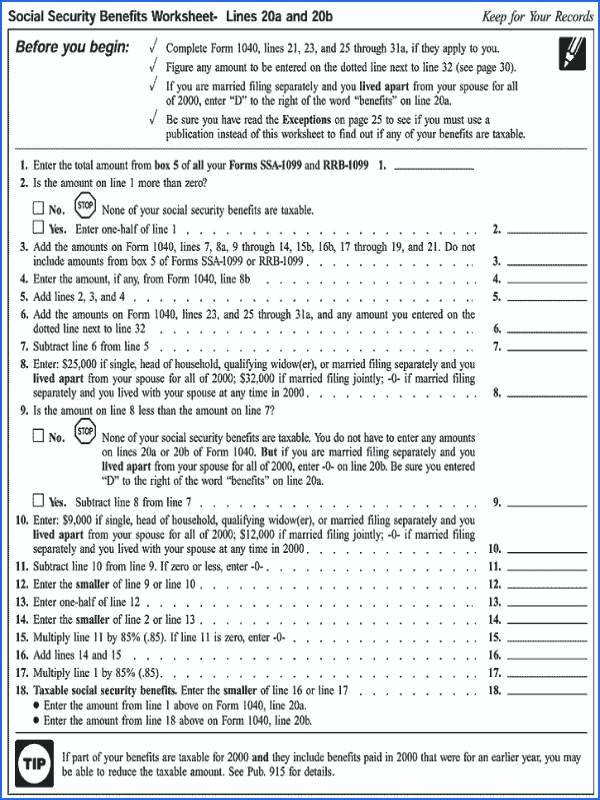

Social Security Benefits Worksheet Lines 6A And 6B - The taxable portion can range from 50 to 85 percent of your benefits. The worksheet provided can be used to determine the exact amount. Individual tax return, lines 6a and 6b, for the taxable amount. You don't need to figure or include the worksheet. If (a) or (b) applies, see the instructions for lines 6a and 6b to figure the taxable part of social security benefits you must include in gross. Social security goes on 1040 line 6a and the taxable amount on 6b. The taxact program transfers the amounts from the worksheets to form 1040 u.s.

The taxact program transfers the amounts from the worksheets to form 1040 u.s. The taxable portion can range from 50 to 85 percent of your benefits. Individual tax return, lines 6a and 6b, for the taxable amount. The worksheet provided can be used to determine the exact amount. If (a) or (b) applies, see the instructions for lines 6a and 6b to figure the taxable part of social security benefits you must include in gross. You don't need to figure or include the worksheet. Social security goes on 1040 line 6a and the taxable amount on 6b.

You don't need to figure or include the worksheet. If (a) or (b) applies, see the instructions for lines 6a and 6b to figure the taxable part of social security benefits you must include in gross. Social security goes on 1040 line 6a and the taxable amount on 6b. Individual tax return, lines 6a and 6b, for the taxable amount. The taxact program transfers the amounts from the worksheets to form 1040 u.s. The worksheet provided can be used to determine the exact amount. The taxable portion can range from 50 to 85 percent of your benefits.

Social Security Benefits Worksheet 2022

The worksheet provided can be used to determine the exact amount. The taxact program transfers the amounts from the worksheets to form 1040 u.s. The taxable portion can range from 50 to 85 percent of your benefits. You don't need to figure or include the worksheet. If (a) or (b) applies, see the instructions for lines 6a and 6b to.

Social Security Benefits Worksheet Lines 6a And 6b

If (a) or (b) applies, see the instructions for lines 6a and 6b to figure the taxable part of social security benefits you must include in gross. The taxact program transfers the amounts from the worksheets to form 1040 u.s. The taxable portion can range from 50 to 85 percent of your benefits. Social security goes on 1040 line 6a.

Social Security Benefits Worksheet Lines 6a And 6b

The taxact program transfers the amounts from the worksheets to form 1040 u.s. Social security goes on 1040 line 6a and the taxable amount on 6b. You don't need to figure or include the worksheet. If (a) or (b) applies, see the instructions for lines 6a and 6b to figure the taxable part of social security benefits you must include.

Lump Sum Social Security Worksheets

You don't need to figure or include the worksheet. The worksheet provided can be used to determine the exact amount. The taxact program transfers the amounts from the worksheets to form 1040 u.s. If (a) or (b) applies, see the instructions for lines 6a and 6b to figure the taxable part of social security benefits you must include in gross..

Social Security Benefits Worksheet Lines 6A And 6B Printable

The worksheet provided can be used to determine the exact amount. If (a) or (b) applies, see the instructions for lines 6a and 6b to figure the taxable part of social security benefits you must include in gross. Individual tax return, lines 6a and 6b, for the taxable amount. The taxable portion can range from 50 to 85 percent of.

Social Security Benefits Worksheet Line 6a And 6b

The worksheet provided can be used to determine the exact amount. Individual tax return, lines 6a and 6b, for the taxable amount. If (a) or (b) applies, see the instructions for lines 6a and 6b to figure the taxable part of social security benefits you must include in gross. You don't need to figure or include the worksheet. The taxact.

Answered Using the Social Security Benefits… bartleby

The worksheet provided can be used to determine the exact amount. Individual tax return, lines 6a and 6b, for the taxable amount. The taxact program transfers the amounts from the worksheets to form 1040 u.s. Social security goes on 1040 line 6a and the taxable amount on 6b. You don't need to figure or include the worksheet.

How to use Social Security Benefits Worksheet—Lines 6a and 6b of 1040

Social security goes on 1040 line 6a and the taxable amount on 6b. The taxable portion can range from 50 to 85 percent of your benefits. The worksheet provided can be used to determine the exact amount. Individual tax return, lines 6a and 6b, for the taxable amount. If (a) or (b) applies, see the instructions for lines 6a and.

Social Security Benefits Worksheet 2023 Line 6a And 6b Socia

The taxact program transfers the amounts from the worksheets to form 1040 u.s. If (a) or (b) applies, see the instructions for lines 6a and 6b to figure the taxable part of social security benefits you must include in gross. The taxable portion can range from 50 to 85 percent of your benefits. The worksheet provided can be used to.

Social Security Benefits Worksheet (2023) PDFliner Worksheets Library

Social security goes on 1040 line 6a and the taxable amount on 6b. If (a) or (b) applies, see the instructions for lines 6a and 6b to figure the taxable part of social security benefits you must include in gross. The taxact program transfers the amounts from the worksheets to form 1040 u.s. You don't need to figure or include.

Social Security Goes On 1040 Line 6A And The Taxable Amount On 6B.

Individual tax return, lines 6a and 6b, for the taxable amount. The taxact program transfers the amounts from the worksheets to form 1040 u.s. You don't need to figure or include the worksheet. If (a) or (b) applies, see the instructions for lines 6a and 6b to figure the taxable part of social security benefits you must include in gross.

The Worksheet Provided Can Be Used To Determine The Exact Amount.

The taxable portion can range from 50 to 85 percent of your benefits.

.png)