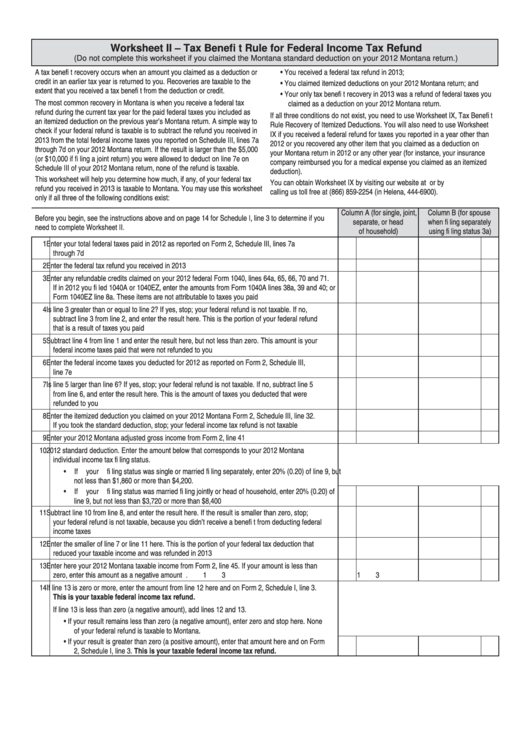

State Tax Refund Worksheet Item B - I'm not aware of receiving a state tax refund worksheet. Use this worksheet only if the taxpayer itemized deductions last year claiming state income taxes as a deduction and received a state or local. If you received a refund for your 2023 state tax return, a portion of that refund needs to be allocated to the payment you made in the. Do i need to complete the state refund worksheet? February 5, 2020 9:55 am. Learn how to accurately enter item b on your state tax refund worksheet, ensuring compliance and optimizing your refund process.

Learn how to accurately enter item b on your state tax refund worksheet, ensuring compliance and optimizing your refund process. If you received a refund for your 2023 state tax return, a portion of that refund needs to be allocated to the payment you made in the. Use this worksheet only if the taxpayer itemized deductions last year claiming state income taxes as a deduction and received a state or local. Do i need to complete the state refund worksheet? February 5, 2020 9:55 am. I'm not aware of receiving a state tax refund worksheet.

February 5, 2020 9:55 am. If you received a refund for your 2023 state tax return, a portion of that refund needs to be allocated to the payment you made in the. Use this worksheet only if the taxpayer itemized deductions last year claiming state income taxes as a deduction and received a state or local. Learn how to accurately enter item b on your state tax refund worksheet, ensuring compliance and optimizing your refund process. Do i need to complete the state refund worksheet? I'm not aware of receiving a state tax refund worksheet.

State Refund Taxable Worksheet Tax State Refund Taxab

Do i need to complete the state refund worksheet? Use this worksheet only if the taxpayer itemized deductions last year claiming state income taxes as a deduction and received a state or local. Learn how to accurately enter item b on your state tax refund worksheet, ensuring compliance and optimizing your refund process. I'm not aware of receiving a state.

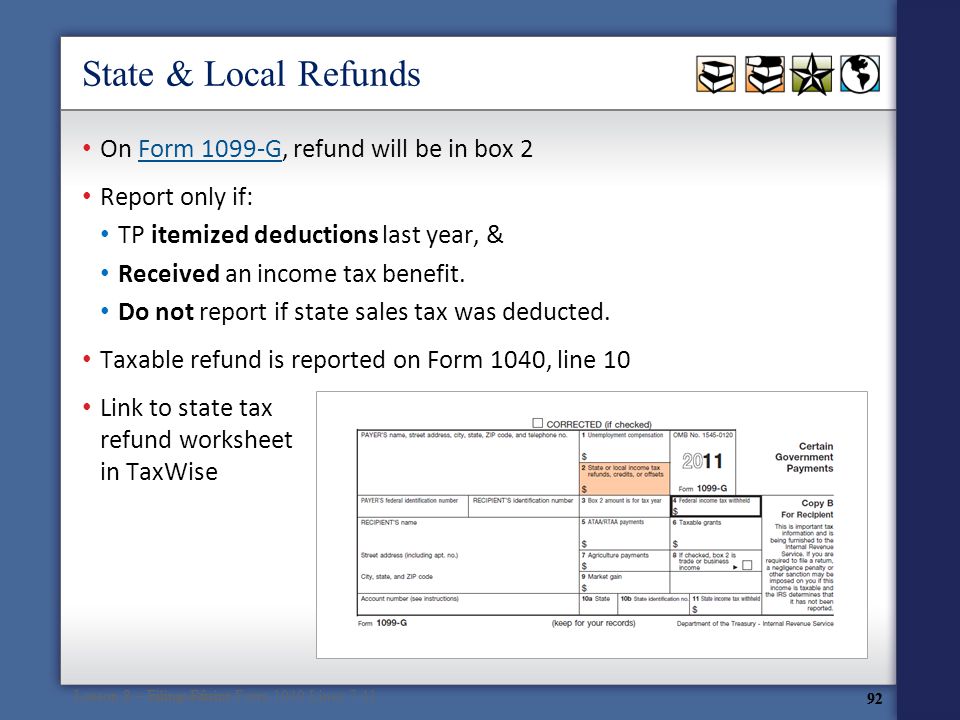

State And Local Tax Refund Worksheet

February 5, 2020 9:55 am. Do i need to complete the state refund worksheet? Learn how to accurately enter item b on your state tax refund worksheet, ensuring compliance and optimizing your refund process. Use this worksheet only if the taxpayer itemized deductions last year claiming state income taxes as a deduction and received a state or local. I'm not.

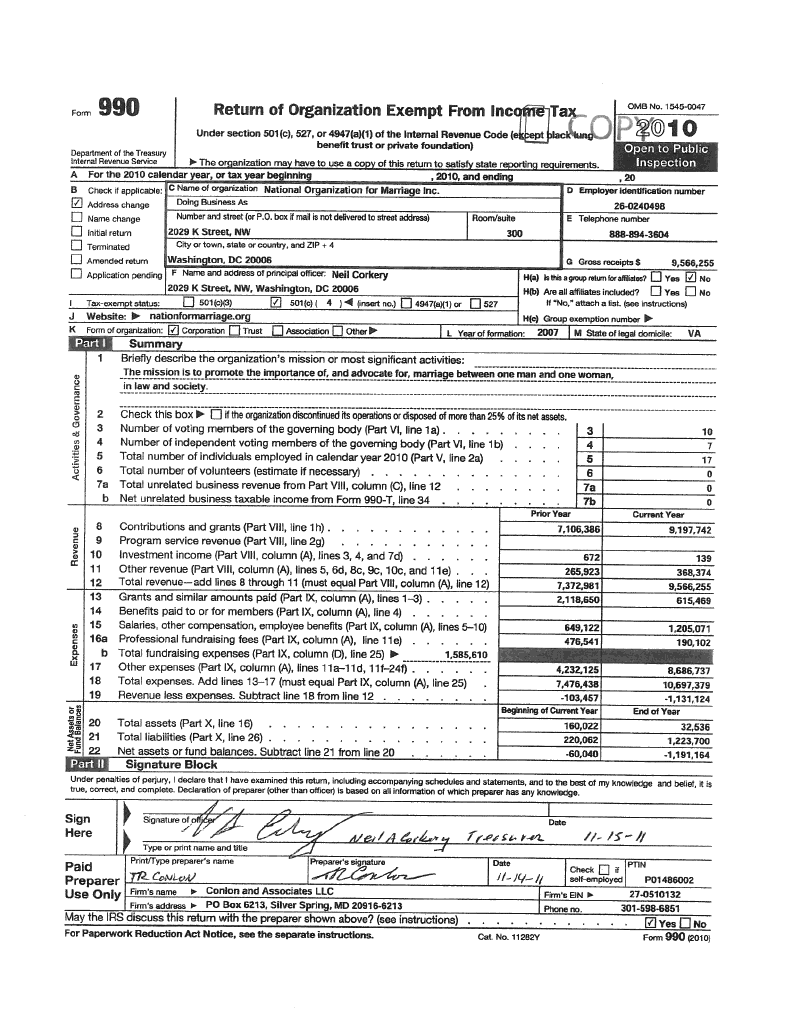

Tax Computation Worksheet 2024 Estimated Tax Payments 2024 W

Learn how to accurately enter item b on your state tax refund worksheet, ensuring compliance and optimizing your refund process. Do i need to complete the state refund worksheet? February 5, 2020 9:55 am. If you received a refund for your 2023 state tax return, a portion of that refund needs to be allocated to the payment you made in.

State And Local Tax Refund Worksheet

Use this worksheet only if the taxpayer itemized deductions last year claiming state income taxes as a deduction and received a state or local. February 5, 2020 9:55 am. I'm not aware of receiving a state tax refund worksheet. If you received a refund for your 2023 state tax return, a portion of that refund needs to be allocated to.

State Tax Refund Worksheet

If you received a refund for your 2023 state tax return, a portion of that refund needs to be allocated to the payment you made in the. February 5, 2020 9:55 am. Use this worksheet only if the taxpayer itemized deductions last year claiming state income taxes as a deduction and received a state or local. I'm not aware of.

Free state and local tax refund worksheet, Download Free state

Use this worksheet only if the taxpayer itemized deductions last year claiming state income taxes as a deduction and received a state or local. February 5, 2020 9:55 am. Learn how to accurately enter item b on your state tax refund worksheet, ensuring compliance and optimizing your refund process. Do i need to complete the state refund worksheet? If you.

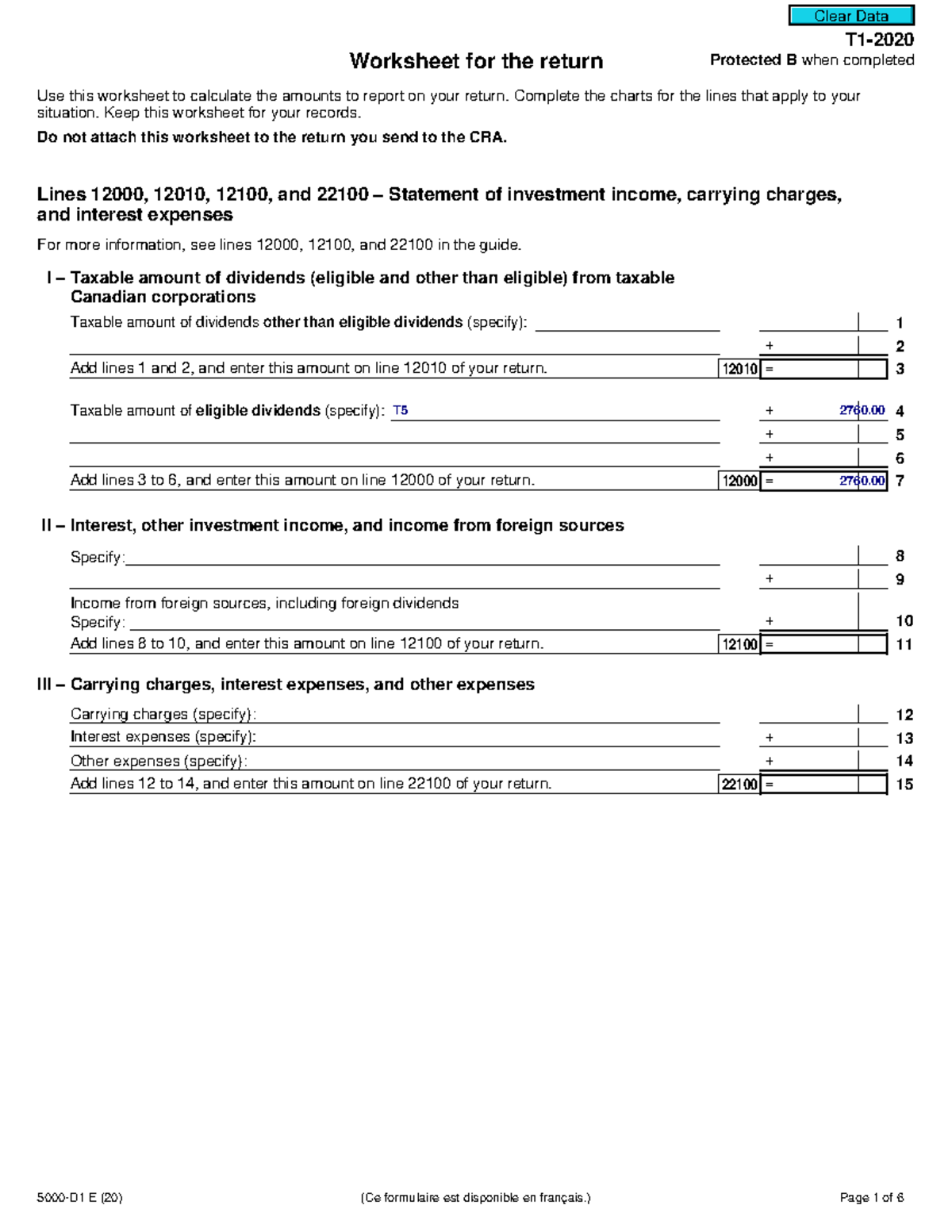

Worksheet 2020 Tax Return T1 Worksheet for the return Protected B

If you received a refund for your 2023 state tax return, a portion of that refund needs to be allocated to the payment you made in the. Learn how to accurately enter item b on your state tax refund worksheet, ensuring compliance and optimizing your refund process. Use this worksheet only if the taxpayer itemized deductions last year claiming state.

State Tax Refund Worksheet Item Q Line 1 Printable Word Searches

Use this worksheet only if the taxpayer itemized deductions last year claiming state income taxes as a deduction and received a state or local. Learn how to accurately enter item b on your state tax refund worksheet, ensuring compliance and optimizing your refund process. February 5, 2020 9:55 am. I'm not aware of receiving a state tax refund worksheet. Do.

State And Local Tax Refund Worksheet

Do i need to complete the state refund worksheet? I'm not aware of receiving a state tax refund worksheet. Learn how to accurately enter item b on your state tax refund worksheet, ensuring compliance and optimizing your refund process. February 5, 2020 9:55 am. Use this worksheet only if the taxpayer itemized deductions last year claiming state income taxes as.

State And Local Tax Refund Worksheet 2019

February 5, 2020 9:55 am. I'm not aware of receiving a state tax refund worksheet. Learn how to accurately enter item b on your state tax refund worksheet, ensuring compliance and optimizing your refund process. Use this worksheet only if the taxpayer itemized deductions last year claiming state income taxes as a deduction and received a state or local. Do.

If You Received A Refund For Your 2023 State Tax Return, A Portion Of That Refund Needs To Be Allocated To The Payment You Made In The.

Use this worksheet only if the taxpayer itemized deductions last year claiming state income taxes as a deduction and received a state or local. February 5, 2020 9:55 am. I'm not aware of receiving a state tax refund worksheet. Learn how to accurately enter item b on your state tax refund worksheet, ensuring compliance and optimizing your refund process.