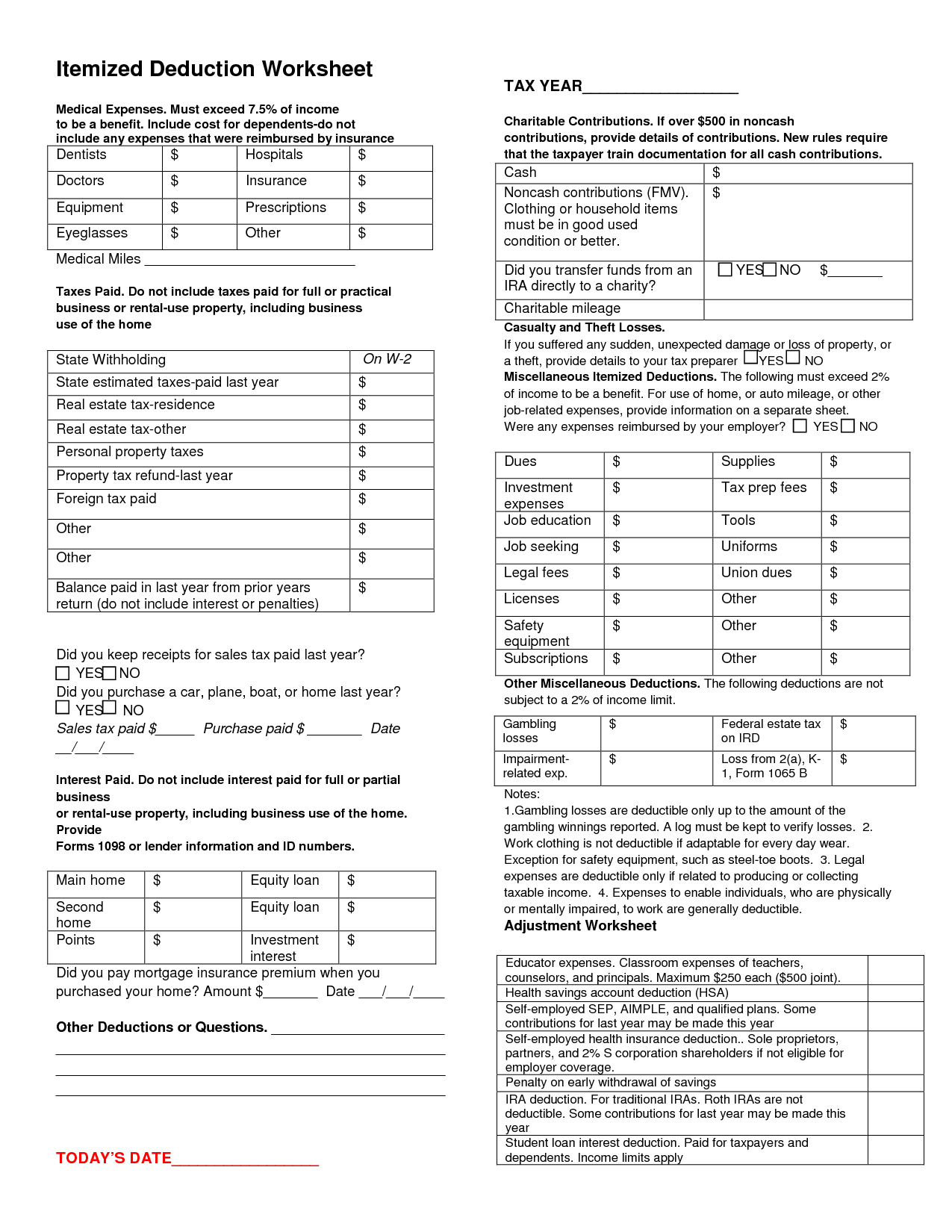

Tax And Interest Deduction Worksheet - Enter amount from form 1098, box 1 (and box 2, if applicable). Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Import prior year's datafile investment taxes In most cases, your federal income tax will be less if you take the. Medical and dental expenses are deductible only to the extent they exceed 7.5%. The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax.

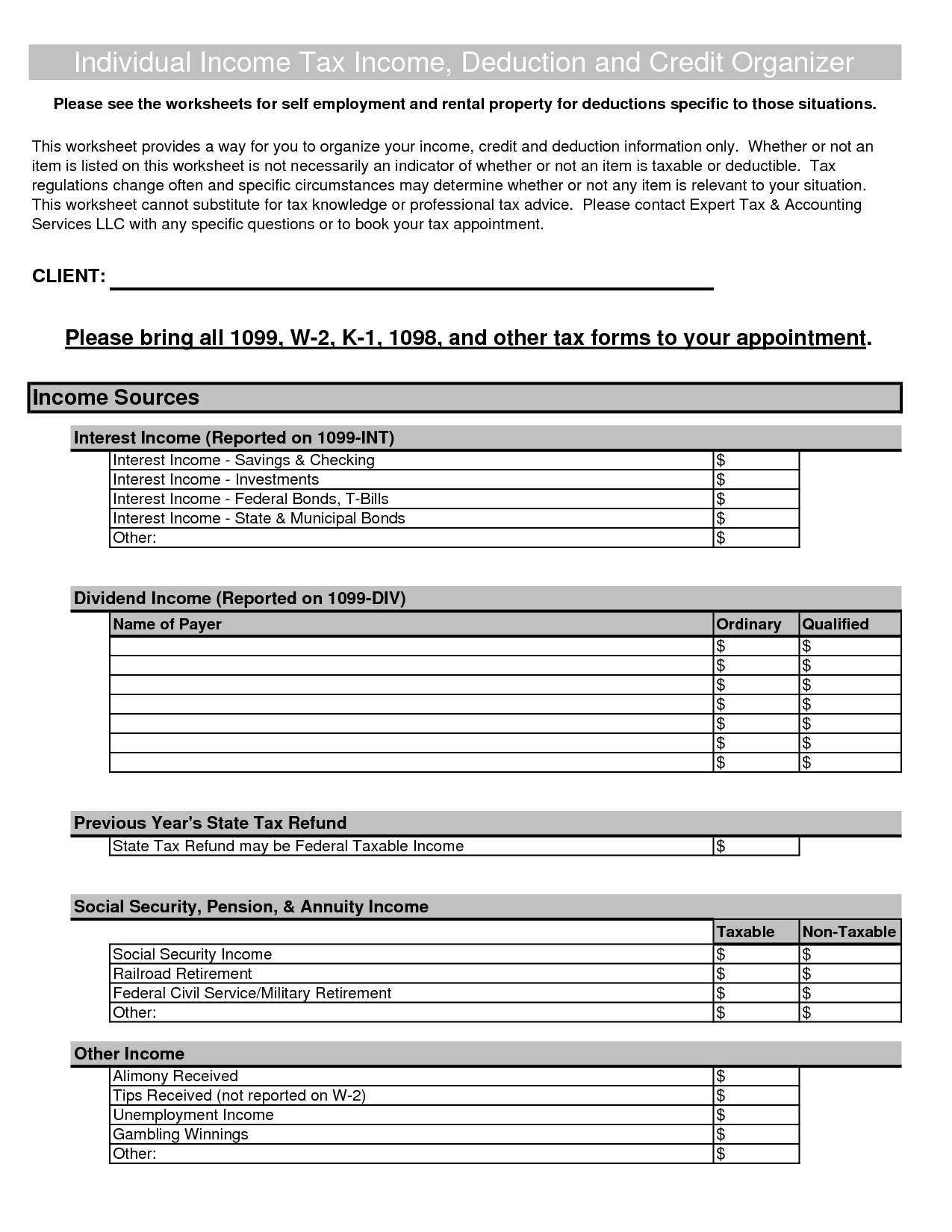

Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. In most cases, your federal income tax will be less if you take the. The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax. Enter amount from form 1098, box 1 (and box 2, if applicable). Medical and dental expenses are deductible only to the extent they exceed 7.5%. Import prior year's datafile investment taxes

Enter amount from form 1098, box 1 (and box 2, if applicable). The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. In most cases, your federal income tax will be less if you take the. Import prior year's datafile investment taxes Medical and dental expenses are deductible only to the extent they exceed 7.5%.

FREE Home Office Deduction Worksheet (Excel) For Taxes Worksheets Library

Import prior year's datafile investment taxes The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax. Medical and dental expenses are deductible only to the extent they exceed 7.5%. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Enter amount from form 1098, box 1 (and box 2,.

Tax And Interest Deduction Worksheet Turbotax Worksheets Library

In most cases, your federal income tax will be less if you take the. Enter amount from form 1098, box 1 (and box 2, if applicable). Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Medical and dental expenses are deductible only to the extent they exceed 7.5%. The tax and interest deduction.

Tax Deduction Worksheets

Enter amount from form 1098, box 1 (and box 2, if applicable). Medical and dental expenses are deductible only to the extent they exceed 7.5%. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Import prior year's datafile investment taxes In most cases, your federal income tax will be less if you take.

Tax And Interest Deduction Worksheets

In most cases, your federal income tax will be less if you take the. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Import prior year's datafile investment taxes Enter amount from form 1098, box 1 (and box 2, if applicable). Medical and dental expenses are deductible only to the extent they exceed.

Tax And Interest Deduction Worksheet Worksheets Library

Medical and dental expenses are deductible only to the extent they exceed 7.5%. Enter amount from form 1098, box 1 (and box 2, if applicable). Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Import prior year's datafile investment taxes The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance.

Tax Itemized Deductions Worksheet

In most cases, your federal income tax will be less if you take the. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Import prior year's datafile investment taxes Enter amount from form 1098, box 1 (and box 2, if applicable). The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring.

Tax And Interest Deduction Worksheet Line 1b

In most cases, your federal income tax will be less if you take the. The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Medical and dental expenses are deductible only to the extent they exceed 7.5%. Enter amount.

18 Itemized Deductions Worksheet Printable /

Medical and dental expenses are deductible only to the extent they exceed 7.5%. In most cases, your federal income tax will be less if you take the. Enter amount from form 1098, box 1 (and box 2, if applicable). Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. The tax and interest deduction.

Tax And Interest Deduction Worksheets

Medical and dental expenses are deductible only to the extent they exceed 7.5%. In most cases, your federal income tax will be less if you take the. Import prior year's datafile investment taxes Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. The tax and interest deduction worksheet helps taxpayers compute eligible deductions,.

Tax And Interest Deduction Worksheet Worksheets, Online taxes, Deduction

Enter amount from form 1098, box 1 (and box 2, if applicable). Medical and dental expenses are deductible only to the extent they exceed 7.5%. The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. Import prior year's datafile.

Medical And Dental Expenses Are Deductible Only To The Extent They Exceed 7.5%.

Import prior year's datafile investment taxes The tax and interest deduction worksheet helps taxpayers compute eligible deductions, ensuring compliance with tax. Download these income tax worksheets and organizers to maximize your deductions and minimize errors and omissions. In most cases, your federal income tax will be less if you take the.