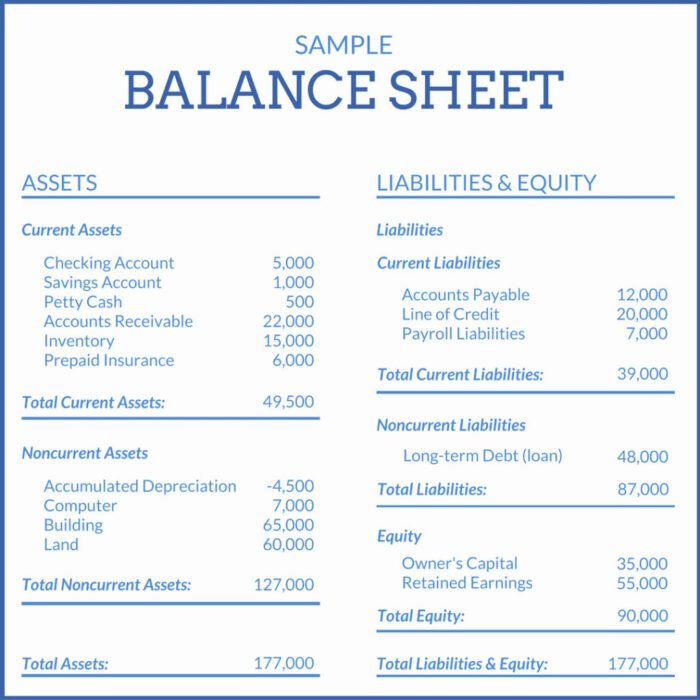

Where Does Accounts Receivable Go On A Balance Sheet - Key takeaways accounts receivable (ar) are. Web updated march 28, 2022 reviewed by jefreda r. Accounts receivable are classified as an asset because they provide value to your. Web accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. If a company has delivered products or services but not yet received. Web accounts receivable are listed on the balance sheet as a current asset. Brown investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable. Web you can find your accounts receivable balance under the ‘current assets’ section on your balance sheet or general ledger. Web accounts receivable (ar) → accounts receivable is a current asset recorded on the balance sheet that captures the outstanding cash payments still owed from customers, i.e. Any amount of money owed by customers for purchases made on credit is ar.

Web accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. Any amount of money owed by customers for purchases made on credit is ar. If a company has delivered products or services but not yet received. Web updated march 28, 2022 reviewed by jefreda r. Brown investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable. Accounts receivable are classified as an asset because they provide value to your. Web accounts receivable (ar) → accounts receivable is a current asset recorded on the balance sheet that captures the outstanding cash payments still owed from customers, i.e. Web you can find your accounts receivable balance under the ‘current assets’ section on your balance sheet or general ledger. Key takeaways accounts receivable (ar) are. Web accounts receivable are listed on the balance sheet as a current asset.

If a company has delivered products or services but not yet received. Web updated march 28, 2022 reviewed by jefreda r. Accounts receivable are classified as an asset because they provide value to your. Key takeaways accounts receivable (ar) are. Any amount of money owed by customers for purchases made on credit is ar. Web accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. Brown investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable. Web accounts receivable are listed on the balance sheet as a current asset. Web you can find your accounts receivable balance under the ‘current assets’ section on your balance sheet or general ledger. Web accounts receivable (ar) → accounts receivable is a current asset recorded on the balance sheet that captures the outstanding cash payments still owed from customers, i.e.

Notes Receivable Definition Accounting

Accounts receivable are classified as an asset because they provide value to your. Web accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. Brown investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable. If a company has delivered products or services but.

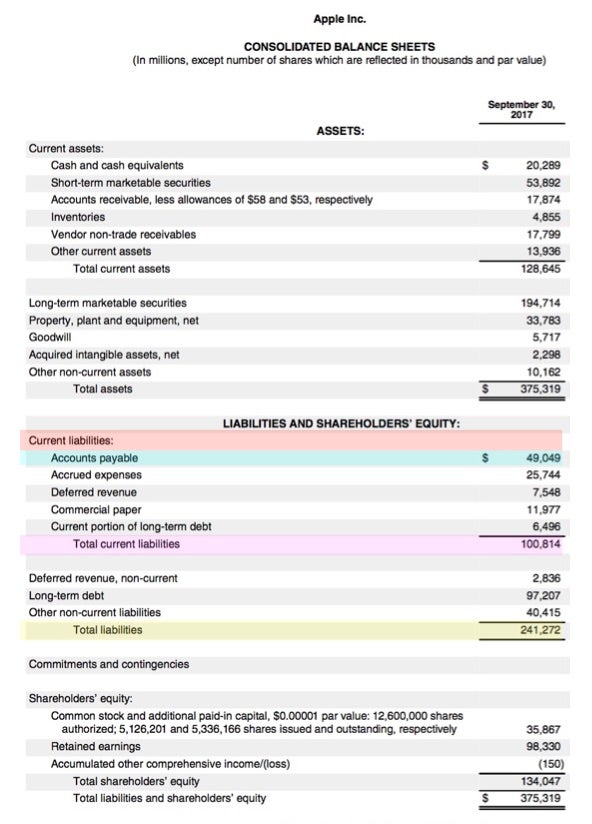

Accounts Receivable (AR) What They Are and How to Interpret Pareto Labs

If a company has delivered products or services but not yet received. Key takeaways accounts receivable (ar) are. Web you can find your accounts receivable balance under the ‘current assets’ section on your balance sheet or general ledger. Web updated march 28, 2022 reviewed by jefreda r. Any amount of money owed by customers for purchases made on credit is.

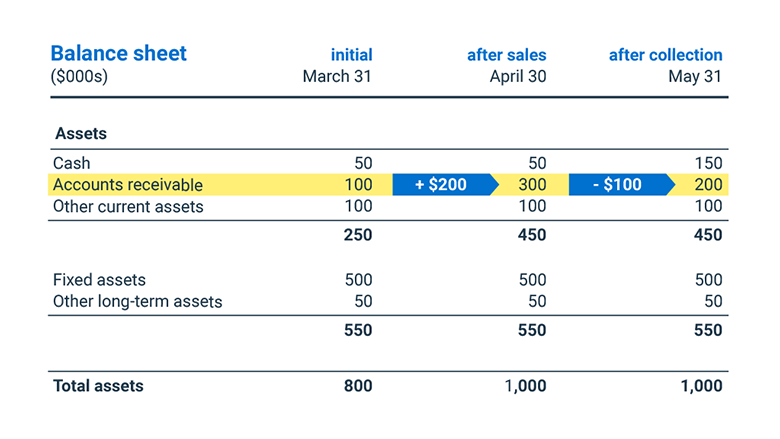

Accounts Receivable on the Balance Sheet

Web you can find your accounts receivable balance under the ‘current assets’ section on your balance sheet or general ledger. Web accounts receivable (ar) → accounts receivable is a current asset recorded on the balance sheet that captures the outstanding cash payments still owed from customers, i.e. Accounts receivable are classified as an asset because they provide value to your..

Accounts receivable BDC.ca

Brown investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable. Key takeaways accounts receivable (ar) are. If a company has delivered products or services but not yet received. Web you can find your accounts receivable balance under the ‘current assets’ section on your balance sheet or general ledger. Web accounts.

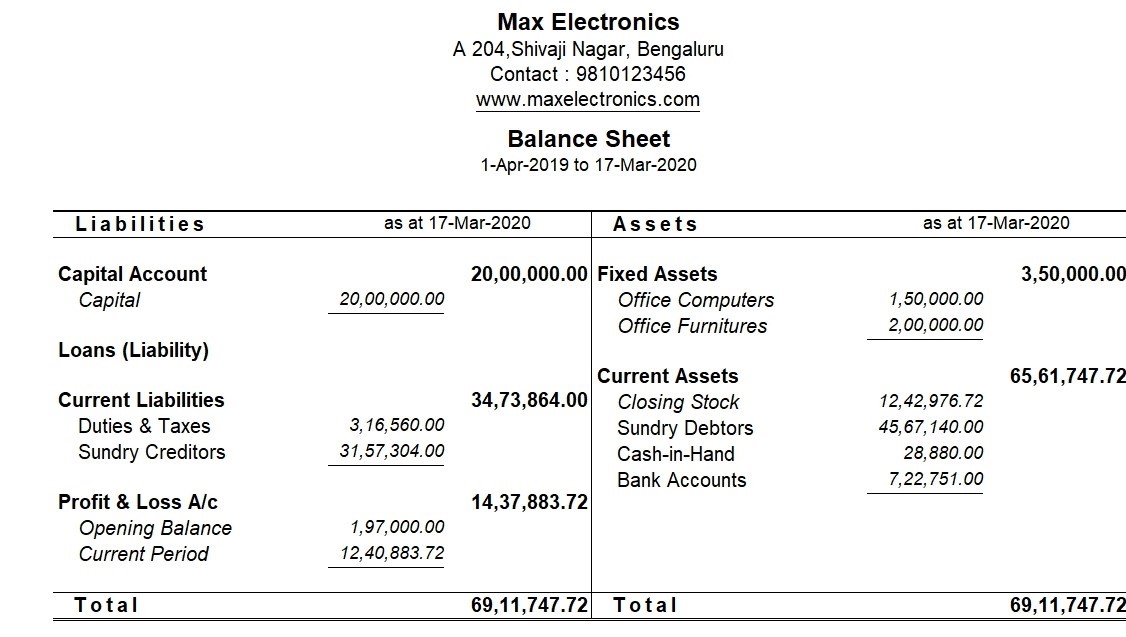

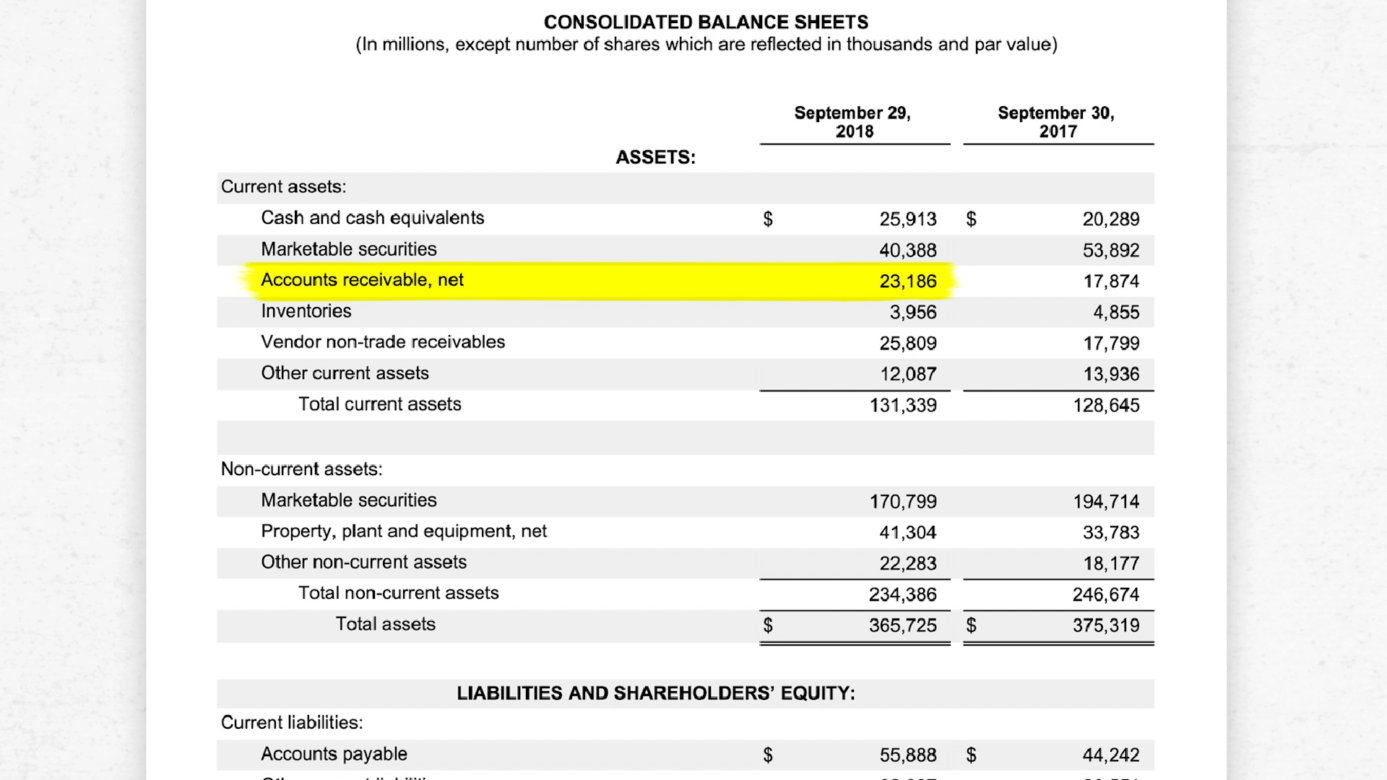

Consolidated Financial Statements Definition & Examples Tally Solutions

Brown investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable. Web updated march 28, 2022 reviewed by jefreda r. Web you can find your accounts receivable balance under the ‘current assets’ section on your balance sheet or general ledger. If a company has delivered products or services but not yet.

Accounts Receivable on the Balance Sheet Accounting Education

Web accounts receivable are listed on the balance sheet as a current asset. Web you can find your accounts receivable balance under the ‘current assets’ section on your balance sheet or general ledger. Web accounts receivable (ar) → accounts receivable is a current asset recorded on the balance sheet that captures the outstanding cash payments still owed from customers, i.e..

The Importance of an Accurate Balance Sheet Basis 365 Accounting

Key takeaways accounts receivable (ar) are. Web you can find your accounts receivable balance under the ‘current assets’ section on your balance sheet or general ledger. Brown investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable. Web accounts receivable (ar) → accounts receivable is a current asset recorded on the.

How do accounts payable show on the balance sheet? شبکه اطلاع رسانی

Web accounts receivable (ar) → accounts receivable is a current asset recorded on the balance sheet that captures the outstanding cash payments still owed from customers, i.e. If a company has delivered products or services but not yet received. Web accounts receivable are listed on the balance sheet as a current asset. Web updated march 28, 2022 reviewed by jefreda.

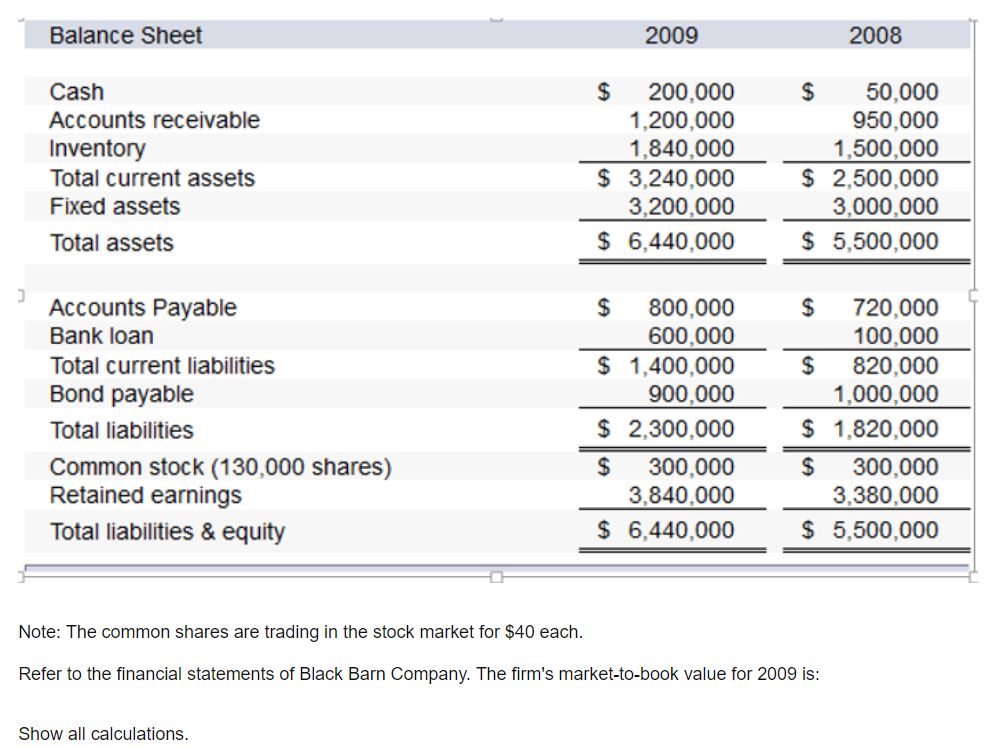

Solved Balance Sheet 2009 2008 Cash Accounts receivable

Web you can find your accounts receivable balance under the ‘current assets’ section on your balance sheet or general ledger. Web updated march 28, 2022 reviewed by jefreda r. Key takeaways accounts receivable (ar) are. Accounts receivable are classified as an asset because they provide value to your. Web accounts receivable, sometimes shortened to receivables or a/r, is money owed.

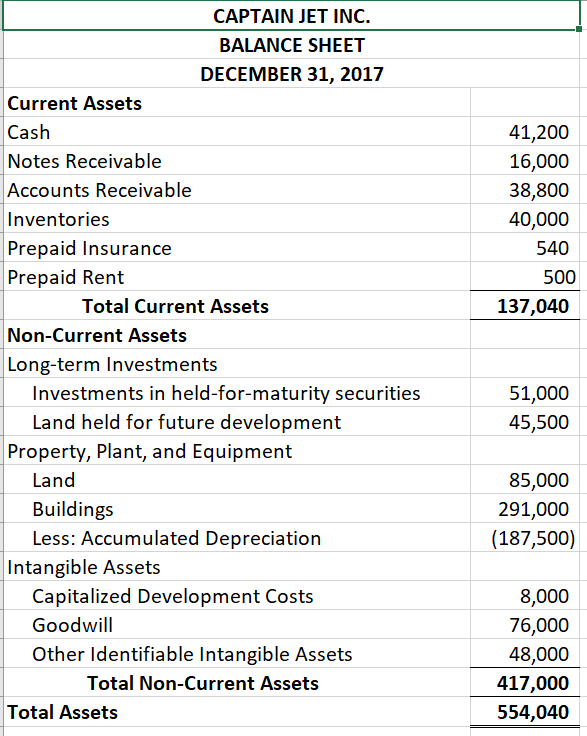

Solved CAPTAIN JET INC. BALANCE SHEET DECEMBER 31, 2017

Any amount of money owed by customers for purchases made on credit is ar. Web updated march 28, 2022 reviewed by jefreda r. Web accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers. Accounts receivable are classified as an asset because they provide value to your. Key takeaways accounts receivable (ar) are.

Key Takeaways Accounts Receivable (Ar) Are.

Any amount of money owed by customers for purchases made on credit is ar. Web accounts receivable are listed on the balance sheet as a current asset. Web you can find your accounts receivable balance under the ‘current assets’ section on your balance sheet or general ledger. Brown investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable.

Web Updated March 28, 2022 Reviewed By Jefreda R.

Web accounts receivable (ar) → accounts receivable is a current asset recorded on the balance sheet that captures the outstanding cash payments still owed from customers, i.e. If a company has delivered products or services but not yet received. Accounts receivable are classified as an asset because they provide value to your. Web accounts receivable, sometimes shortened to receivables or a/r, is money owed to a company by its customers.

:max_bytes(150000):strip_icc()/accounts-receivables-on-the-balance-sheet-357263-final-911167a5515b4facb2d39d25e4e5bf3d.jpg)